What is the optimal investment?

CFD trading democratises the markets by providing a low entry level. G Assets LTD has traders who open positions worth more than $1m a time, but the minimum deposit you can trade online with is just $50 (€50, £50, 500PLN).

If you are using wire transfer, the minimum deposit is €250.

You can open an account for free and practise in demo mode.

CFD trading is usually considered a cost-effective way of entering the financial markets. With some brokers, CFD costs include a commission for trading various financial assets, however, G Assets LTD doesn’t take commissions for opening and closing trades, for deposits or withdrawals.

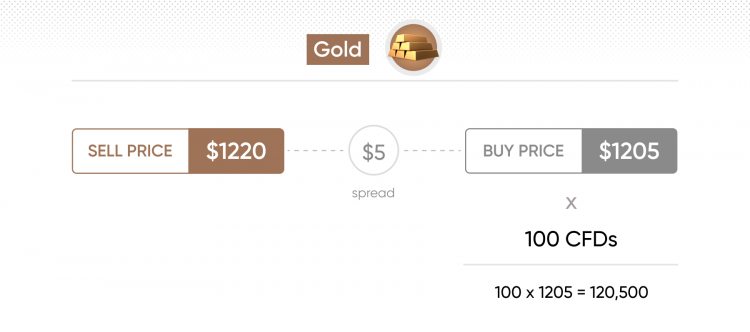

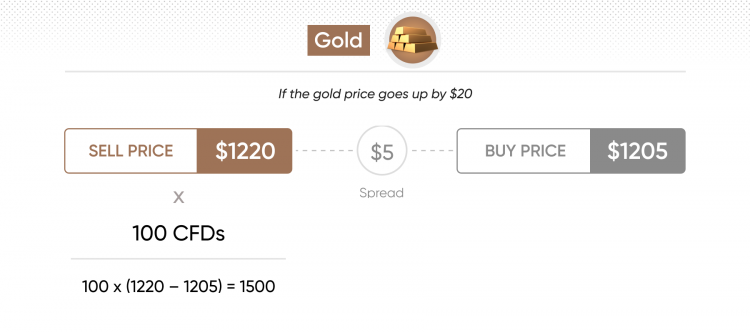

The major CFD cost is the spread – the difference between the buy and sell price at the time you trade. There is an additional charge of an overnight fee, which is taken if a trade is kept open overnight or all day, depending on the region.

As contracts for difference are leveraged products, you can open much larger positions with a lower initial deposit than you need to buy traditional shares. Note that leverage magnifies both profits and losses. For example:

| Buying Apple | CFD trade | Share trade |

|---|

| Sell / Buy Price | 135.05 / 135.10 | 135.05 / 135.10 |

| Deal | Buy at 135.10 | Buy at 135.10 |

| Deal size | 100 shares | 100 shares |

| Funds required to open a trade | $ 2,702 = $135.10 Buy price x 100 shares x 20% margin (Margin required) | $13,510 (100 shares at 135.10) |

| Close price | Sell at 150 | Sell at 150 |

| Profit | $1,490

((150 – 135.10) x 100 shares = $1,490) | $1,490

(15,000 – 13,510 = $1,490) |

What assets can you trade with CFDs?

You can trade CFDs on shares, indices, ETFs, commodities and currencies, as well as other smaller markets. G Assets LTD provides access to thousands of different CFD assets across these classes, so you are only a few clicks away from trading the world’s most popular markets all in one place.

The choice of available CFD options is constantly growing. In 2020, G Assets LTD significantly expanded its offering and added new markets, which will bring many new trading options. They include: thematic indices (Corona Anti-virus Index), futures (US crude oil, UK Brent oil), MOEX and SGX-traded stocks.

Example CFD trades: Long, short and margin trading

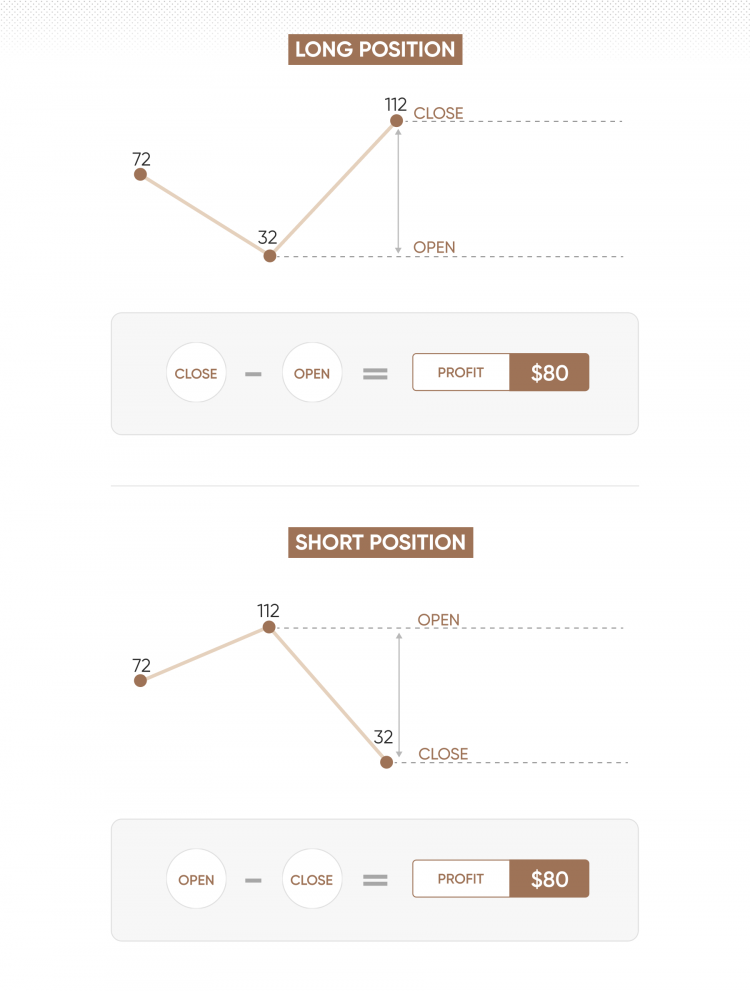

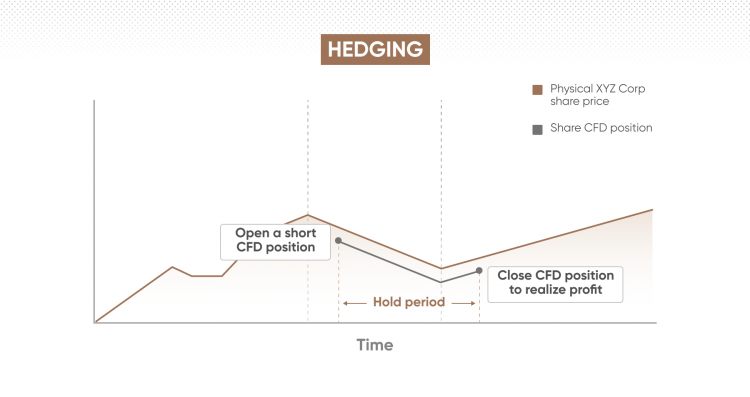

Contracts for difference allow you to speculate on an asset’s price movement in either direction. This means you can potentially profit not only when an asset rises in price (goes long), but also when it falls (goes short).

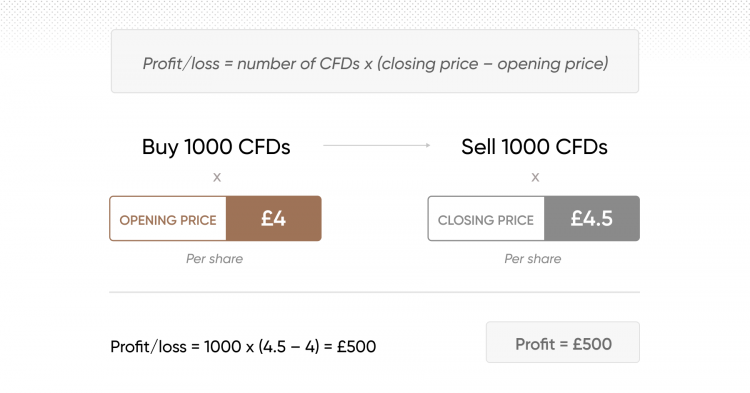

When you open a CFD position, you select the number of contracts you would like to trade (buy or sell). Your profit will rise in line with each point the market moves in your favour. Conversely, you could make a loss if the market moves against you.

Going long CFD trading example

You think Apple shares are going to appreciate and want to open a long CFD position.

You purchase 100 CFDs on Apple shares at $160 a share. The total value of the trade is $16,000. If Apple appreciates to $170, you make $10 a share – a $1,000 profit. If, however, the price falls to $150 a share, you lose $10 a share – a $1,000 loss.

Example steps of that possible trade are:

The share price is $165. You start looking at the market.

The share price falls to $160. You decide to open a trade (buy the CFDs).

The price of your CFD rises to $170. You close your trade (sell the CFDs), making a profit of $10.

Please note that there is always a risk of loss with any trade.

Going short CFD example

You think the Apple price will fall. You can open a short CFD position. This is known as short-selling.

You decide to sell 100 CFDs on Apple at $170 a share. The price falls to $160, giving you a profit of $1,000, or $10 per share. If, however, the price rises to $180 a share, you lose $1,000, or $10 a share.

Example steps of that possible trade:

The share price is $165. You start looking at the market.

The price of your CFD rises to $170. You open a trade (sell the CFDs).

The price falls to £160. You close your trade (buy the CFDs).