Common forex market terms

Before you learn how to start forex trading, it’s useful to know some of the common language used by traders. Here’s a simple glossary of some of the terms you’ll come across:

Aussie – slang term for the Australian dollar

Ask price – the price at which a trader can buy

Base currency – the first currency shown in a currency pair – in USD/EUR the US dollar is the base currency

Base rate – the lending rate set by a country’s central bank

Basis point – equal to 1/100th of 1%, or 0.01% – or 0.0001 in the price of a currency pair. Often called a “pip”

Bear market/bearish – indicating a market or asset price in decline

Bear – traders who expect prices to fall and may be holding short positions

Bid-ask spread – the difference between the buy price and the sell price

Bid price – the price at which a trader can sell

Bull market/bullish – indicated a market or asset price that is rising

Bull – a trader who expects prices to rise and may be holding long positions

Cable – slang term for the GBP/USD currency pair

Counter currency – the second currency in a currency pair – in USD/EUR the euro is the counter currency

Counterparty – a participant in a transaction

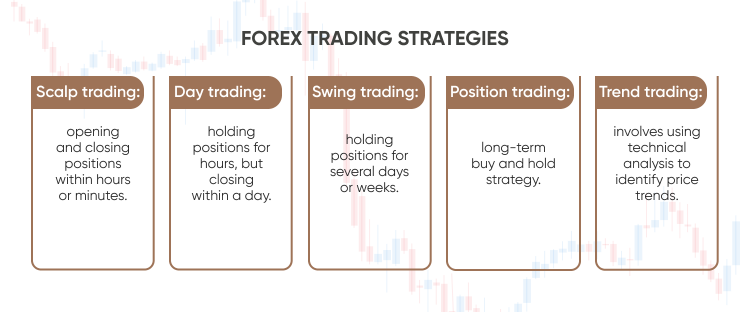

Day trading – entering and exiting a forex trade on the same day. This is the typical strategy employed on CFD trading platforms

Derivative – a financial product whose value is based on an underlying asset

Dollar index – a measure of the US currency’s strength relative to a basket of other currencies that include the euro, the pound and the yen. Its symbol is DXY

Dove/dovish – relating to monetary policy that supports lower interest rates. Opposite of hawkish

Greenback – slang term for the US dollar, also buck

Hawk/hawkish – relating to monetary policy that supports higher interest rates. Opposite of dovish

Hedge – a trading position or positions that helps reduce risk on your primary trading positions

Kiwi – slang term for the New Zealand dollar

Leverage – this allows a trader to open positions much larger than his up-front capital can cover. It means that you can maximise your profits significantly on winning trades, but risks you losing much more than your initial deposit. Take note of the risk warnings on trading platforms and trading apps that offer leveraged trading

Liquidity – a highly liquid market has enough volume of trade to ensure smooth price movements. Illiquid markets have low levels of trading activity and can result in price volatility

Loonie – slang term for Canadian dollar

Lot – forex is traded in units of currency known as lots. The typical lot size is 100,000 units, although you can also deal in mini lots of 10,000 units and micro lots of 1,000 units.

Margin – margin is related to leverage, and represents the minimum amount of cash you need to deposit to trade at your specified leverage

Margin call – when your open position moves against you, your broker will make a margin call for you to supply additional funds to cover your margin

Open position – an active trade

Pip – stands for “price interest point” and is the smallest amount by which a currency pair’s price can change. On quoted currency pairs, a single pip will be 0.0001.

Spread – this is the difference between the bid – or sell – price, and the ask – or buy – price on a currency pair.

Sterling – alternative name for the UK pound

Tick – a minimum change in price, or a pip

What moves forex prices?

FX rates fluctuate constantly throughout the day, based on whether one currency is in higher demand than the other. As the forex market covers currencies from around the world, there are many factors that can drive the direction of different pairs, based on their perceived value to pay for goods and services or to invest in.

If you want to learn forex trading, here are some of the factors that can affect currency values you need to know about.

Economic releases

The value of a nation’s currency is in large part determined by the health of its economy. Forex markets react to releases of key economic data, as they give a picture of how the country’s economy is performing and how it compares with other countries.

Gross Domestic Product (GDP), which measures the value of all the finished goods and services a country produces in a certain period, is one of the most important metrics to gauge a country’s economic performance.

Political news and events

Currency prices also react to political news and events domestically and internationally. As the global reserve currency, the US dollar is considered a safe haven, which increases its value during times of macroeconomic uncertainty and political instability.

An example of the impact a political event can have on the currency would be the Russian ruble, which lost a third of its value in the two weeks after Russia invaded Ukraine and Western countries imposed sanctions. The rouble reversed the price action later, quickly recovering to the pre-invasion levels and above amid higher oil and gas prices.

Interest rates

A country’s monetary policy stance in response to inflation is an important driver as higher interest rates attract investors to earn higher returns on their money. For this reason, forex rates tend to move in favour of the currency that has the highest interest rates.

Commodity prices

The cost of commodities can drive currencies in different directions depending on whether their countries are net importers or net exporters. Currencies from countries that export large volumes of commodities, such as the Australian dollar, New Zealand dollar and Canadian dollar, are called commodity currencies.

How to trade forex

If you are interested in how to trade forex, there are several instruments you can use depending on your trading strategy and market predictions.

The vast majority of FX transactions are executed by large institutions through the interbank market, often running into hundreds of millions of dollars at a time. But with the advent of online forex trading platforms – as opposed to physical exchanges – retail traders can now get involved in the currency markets too.