What is an ETF trading strategy?

Once you’ve decided to invest in ETFs, you need to form your investing strategy. There are several different ETF trading strategies you can use, depending on your preferred approach, risk tolerance, timeframe and overall trading or investing goals.

Dollar-cost averaging

By purchasing an asset like an ETF on a regular basis, you can average out the price you pay over time as the price fluctuates.

Rather than making a single investment at a certain price, you can invest the same amount at regular intervals. This can reduce your average purchase price over time, allowing you to take advantage of market dips to turn a profit, although there is always the risk of making a loss.

Asset allocation

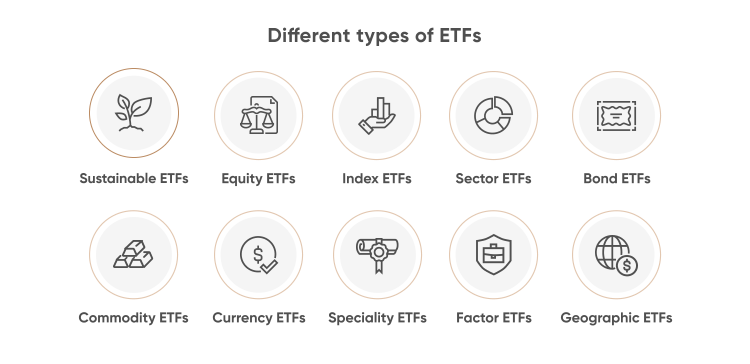

ETFs can make it easier for investors to construct their portfolios when starting out and rebalance over time. An investor can allocate a portion of their portfolio to a specific sector, such as technology or consumer staples, or to a specific asset class, like bonds or commodities.

Swing trading

Swing trades capitalise on large swings in an asset’s price. ETFs can be suitable for this as they have tight bid and ask spreads, so the difference in price does not get lost in the spread.

Traders can choose to swing trade an ETF that covers a specific industry or asset class that they have particular knowledge of, allowing them to identify drivers for large price movements. Note that swing trading is typically a short and medium-term strategy.

Sector rotation

Investors often rotate their holdings into and out of specific industries, depending on economic trends. During times of strong economic growth, they might choose to focus on high-growth stocks, but when economies slow down, they rotate out of growth stocks and into value stocks.

If an investor’s portfolio becomes overweight in a specific sector, they can sell some of their ETF holdings to invest in a different sector so the portfolio does not become overly concentrated.

Short selling

Short selling is a high-risk strategy that involves borrowing a financial instrument or security to sell it. Short selling ETFs carries lower borrowing costs than individual assets and lower risk of a short squeeze, when a heavily shorted asset price spikes higher as traders are forced to cover their positions.

Short selling ETFs enables traders to speculate on broad trends. For example, a trader expecting growth in emerging markets to slow down could short an emerging markets ETF.

Seasonal trend trading

ETFs can provide a convenient way for traders to potentially capitalise on seasonal changes in asset prices. Although, as with all trading strategies there is always a risk that they could lose their capital.

For example, gold prices tend to rise in the autumn and winter on higher demand for jewellery from India and China during festivals and holidays.

Energy prices tend to rise during the winter when demand for heating is higher, or during the summer when air conditioning use peaks.

Hedging

ETFs offer investors a simple way to hedge their portfolios against downside risk. They are one of the easiest ways to invest in commodities like precious metals, which provide a hedge against economic uncertainty, rising inflation and low interest rates.

While advanced investors can trade put options on specific securities to hedge their portfolios, ETFs make it straightforward to take a short position on a certain sector or the broader market.

Depending on your circumstances, you can choose a combination of ETF investing strategies.

How to trade ETFs with CFDs

Are you interested in trading ETFs with CFDs? Using CFDs to trade ETFs allows you to gain exposure to short-term price fluctuations in specific sectors or countries. Trading CFDs allows you to use leverage to amplify your exposure to the ETF, so you can open a bigger position with a smaller deposit. Remember that leverage can magnify both profits and losses.

If you want to start ETFs trading using CFDs, sign up for an account with a CFD provider like G Assets LTD. You can trade ETF CFDs along with CFDs of commodities, stocks and forex in the same account.

To get started, you can follow these simple steps:

Create and login to your CFD trading account

Choose which ETF you want to trade

Use your preferred trading strategy to identify trading ideas

Open your first trade. You can set a stop loss or a guaranteed stop loss to manage risk

Monitor your trade using technical indicators and fundamental analysis

Close your position in line with your trading strategy

Pros and cons of trading ETFs with CFDs

Trading ETFs with CFDs offers gaining diversified exposure to a basket of assets without having to carry out research on individual components. You can use ETFs to take positions on broad trends such as seasonal changes, sector rotation, or economic performance in a particular country.

CFDs provide flexibility to trade in both directions. Whether you have a bullish or bearish view of an ETF price, you can speculate on either upwards or downward price movement. CFDs use leverage so that you can take a large position with only a small initial investment of capital.

For example, a 10% margin means that you have to deposit only 10% of the value of the trade you want to open, and the rest is covered by your CFD provider. If you want to place a trade for $1,000 worth of CFDs and your broker requires 10% margin, you will need only $100 as the initial capital to open the trade.

However, you should be aware that trading CFDs also carries risks as they are leveraged products that multiply the size of losses if the price moves against your position, as well as maximising gains if the price moves in the same direction. It is important to do your own research and understand how leverage works and before you start ETF trading with CFDs.

Note that CFDs also imply overnight fees, meaning that they are more appropriate for short-term ETF trading, rather than long-term investing.

Why trade ETFs with G Assets LTD

If you are looking for how to trade ETFs using CFDs, G Assets LTD offers advanced features to enhance your strategy and generate better results.

Advanced AI technology at its core: A personalised news feed provides users with unique content depending on their preferences. The neural network analyses in-app behaviour and suggests videos and articles that fit your trading strategy. This will help you to refine your approach when you trade ETF CFDs.

Trading on margin: Thanks to margin trading, G Assets LTD allows you to trade ETFs, and other top-traded assets, even with a limited amount of funds in your account. Keep in mind that CFDs are leveraged products, which means both profits and losses can be magnified.

Trading the difference: By trading ETFs with CFDs, you do not buy the underlying asset itself. You only speculate on the rise or fall of its price. A CFD trader can go short or long, set stop and limit orders, and apply trading scenarios that align with their objectives. CFD trading is no different from traditional trading in terms of its associated strategies. However, CFD trading is short-term in nature, due to overnight charges. Plus, there are extra risks associated with leverage as it can magnify both profits and losses.

All-round trading analysis: The browser-based platform allows traders to shape their own market analysis and forecasts with sleek technical indicators. G Assets LTD provides live market updates and various chart formats, available on desktop, iOS and Android.

ETF trading hours

If you are going to start trading ETFs you need to be aware of the market’s working hours. An ETF’s trading time is the same as that of the stock exchange where the ETF is listed.

For example, the ETF market open time for a US-listed fund is 09:30 to 16:00 EST. Some broker platforms offer pre-market or after-hours trading, allowing you to buy and sell stocks and ETFs a few hours before or after the market opens and closes.

At G Assets LTD, ETF CFDs are available for trading depending on the asset. You can always check an ETF’s trading hours on its market page on our website or mobile platform. For example, SPDR S&P 500 ETF Trust (SPY) CFDs are traded from Monday to Friday, 13:30 – 20:00 (UTC).