Day trading strategy

One of the most popular active trading crypto strategies, day trading involves constant position monitoring. Day trading presupposes entering and exiting positions during a single day to speculate on an asset’s intraday price movements.

When it comes to cryptocurrency markets, which are open 24 hours a day, 365 days a year, the meaning of day trading slightly differs. It usually refers to a short-term trading approach, when traders open and close their positions within 24 hours or less.

Swing trading strategy

Swing trading is a longer-term trading strategy. Traders usually hold positions for longer than one day, but usually no longer than a month. Swing traders usually try to benefit from volatility waves, which can often last for several days or weeks. They use a combination of fundamental and technical analysis to make thorough trading decisions.

A swing trader would buy a cryptocurrency if they expect the price to increase over the coming months due to the upcoming blockchain upgrade, such as with Ethereum’s ‘The Merge’.

Trend trading strategy

Also referred to as position trading, a trend trading strategy suggests traders hold positions for a longer timeframe, usually a couple of months. Trend traders try to benefit from the cryptocurrency’s directional trends.

For example, trend traders would open a long position in an uptrend and go short in a downtrend. They mostly rely on fundamental factors behind the asset’s price action, considering events that might take a longer time to play out. However, trend traders should always keep in mind the possibility of a trend reversal.

Scalping strategy

One of the fastest trading strategies, scalping does not wait for big moves or clear trends to play out, speculating on small changes in the price. Scalpers determine entry points for positions without the use of technical or fundamental analysis, but based on the market depth, benefitting from the non-stop activity of the markets.

Scalping is considered an advanced trading strategy, not recommended for beginners. It is often used by whale traders. As the percentage profit targets are small, larger positions make more sense.

Range trading strategy

In range trading, traders focus on using technical analysis to identify support and resistance levels for a cryptocurrency price as the price trend is likely to remain within that range for a period of time.

A range trader would typically buy when the price nears the support level and sell when it approaches resistance. The trader will also be on the lookout for when the price breaks out of the range below support or above resistance.

High-frequency trading strategy

High-frequency trading (HFT) is an advanced trading strategy that uses algorithms and bots to automatically enter and exit trades. HFT encompasses computer science, complex market concepts and mathematics and is not suitable for individual beginner investors.

HFT traders use fact order execution speed to succeed. Some of the institutions involved in HFT include Virtu Financial, Citadel Securities, Tower Research.

Dollar-cost averaging strategy

As it is so difficult to time the market perfectly, entering a position precisely at the bottom and exiting exactly at the peak, even with the best technical analysis tools, an alternative is dollar-cost averaging. This approach is typically used for long-term investing rather than short-term price speculation.

As with stock investing, dollar cost averaging refers to buying a cryptocurrency at regular intervals. In this way, you will buy continuously whether the price is high or low, resulting in an average purchase price that is lower than the highs and still gives you scope to potential profit. This takes away the stress of deciding when to buy, although you would still need to analyse market trends to decide when to sell and take potential profits.

For example, a cryptocurrency investor may commit $50 a month to buy a coin of their choice on the 1st date of each month as part of their dollar-cost averaging approach.

How to trade cryptocurrency CFDs

Are you interested in trading cryptocurrency CFDs? Sign up for an account with a CFD provider like G Assets LTD. You can trade CFDs on cryptos along with stocks, commodities and forex all in the same trading account.

Follow these steps to get started:

- Create, verify and login to your trading account

- Deposit funds in your chosen fiat currency and choose which cryptocurrency CFD you want to trade

- Use your preferred trading strategy and charting tools to identify buy and sell opportunities

- Open your first long or short position and consider using risk management tools such as a stop loss or a guaranteed stop loss to manage risk

- Monitor your trade using technical and fundamental analysis based on your strategy

- Close your position when your trading strategy indicates

Cryptocurrency trading CFD example

How does a cryptocurrency CFD trading work in practice? We’ve compiled a simple example and outlined the possible outcome.

CFD trade: Selling ether (ETH)

The price of Ethereum’s coin, ether, hit its all-time high of $4,362 on 12 May 2021. It fell to around $1,800 in August 2022. Let’s assume you believe the price of ether is going to rebound and decide to go long, buying ether against the US dollar (ETH/USD).

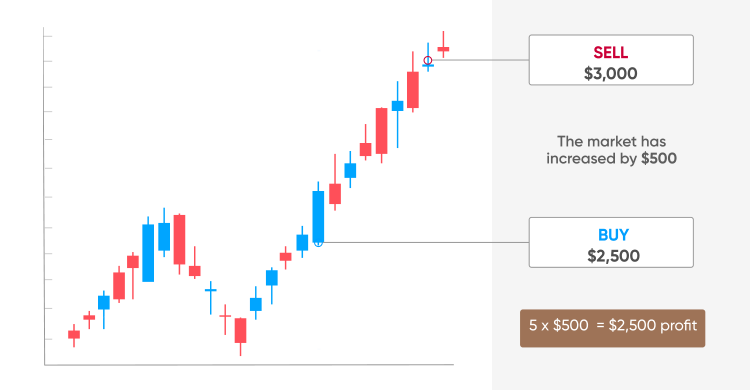

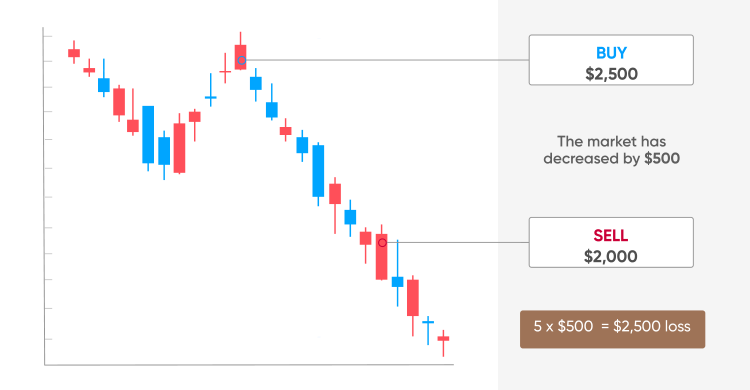

In our example, the current market price of ether is $2,500 and you decide to buy five contracts (each equivalent to one ETH) to open a trade at this price (without leverage at 1:1).

Result A: A winning trade

If your prediction was right, and ether’s price moves up, your trade would be profitable. Let’s assume that the new ETH price is $3,008. You could close your position and take your profit by selling five contacts to close your position at the sell price of $3,000 (slightly lower than the mid-price due to the spread).

Because the market has moved $500 in your favour ($3,000-$2,500), the profit from your ETH trade would be: 5 x $500 = $2,500