There are a number of steps a trader could take if they hope to build an effective swing trading strategy.

Identifying their market. As a first step traders could identify which market they wish to trade in. This could be stocks, futures, foreign exchange (forex), commodities, etc.

Utilising fundamental and technical analyses. These analyses could be helpful in letting traders determine when to enter and exit trades.

Setting risk parameters. This could include setting stop losses – or guaranteed stop losses, which have no risk of slippage but incur a fee if triggered – profit targets and position sizing.

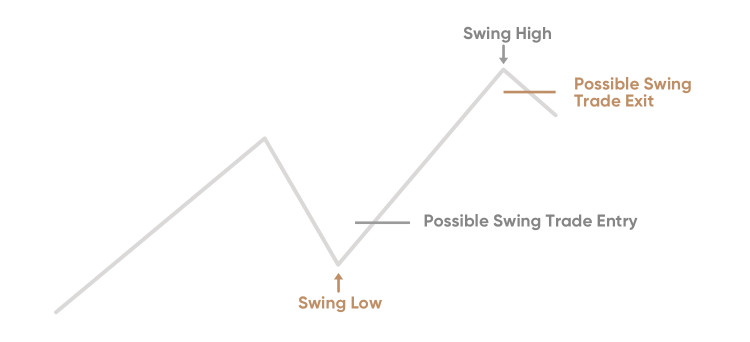

Developing an entry and exit strategy. An entry and exit strategy could include criteria for entering and exiting trades, as well as any trailing stops or profit targets traders may choose to utilise.

Backtesting the strategy. Traders may find it useful to test their strategy before risking any funds, to help identify potential weaknesses and improve their strategy over time.

Executing the trades. Once traders have developed and tested their strategy, they may decide to begin executing trades. However, it’s important to remember that even with a carefully thought-out strategy there is always the risk of making a loss. Before making any decision, traders should consider how comfortable they are losing money, their expertise in the market and the diversity of their portfolio among other factors. They should also never trade money they can’t afford to lose.

Swing trading strategies and techniques

How do you swing trade? There are several different swing trading strategies often implemented by traders. Below are some of the most popular.

Breakout

A breakout technique is an approach where a trader takes a position on the early side of the uptrend, looking for a market or stock that is most likely to ‘break out’. The trader gets into the trade as soon as they see the desired level of volatility and movement of a stock that breaks a key point of stock’s support or resistance.

Breakdown

A breakdown strategy is the opposite of a breakout. The market price goes lower than a defined support level and the chart points toward lower prices. Then, traders monitor the same fundamentals as with breakouts.

Reversal

This swing trading technique uses price-changing momentum when its growth or fall slows down before having a complete reversal.

Retracement

A concept that is quite similar to reversal. Retracement is applied when the price reverses within a larger trend, but not to its high or for any length of time. A stock temporarily retraces to an earlier price point and then continues to move in the same direction later.

Swing trading vs day trading

Like swing trading, day trading involves holding an asset for a short amount of time. However, with day trading the assets are held for less than a day; sometimes just a few hours or even minutes.

Day trading is considered one of the most speculative strategies as traders attempt to profit from very short-term movements in the stock market, selling at a predetermined price to hedge against the risk of any counter moves that might happen during out-of-hours trade.

Each trading strategy has its advantages and disadvantages. On a surface level, day trading could have a higher chance for gains as day traders would make a higher number of trades in the same time frame as swing traders. However, in actuality, factors such as the strength of a trader’s strategy, their knowledge of the market and the strength of their research may have a much greater effect on the gains or losses they make.

Conclusion

Understanding swing trading could help traders make more informed decisions about whether the strategy is suitable for them. Swing trading can help traders to diversify their portfolio. Yet, it is important to remember that every trading method has its pros and cons, and it is up to the trader which one of them he or she will choose.

It’s important that each trader does their own research and remembers that the decision to trade and which strategy to choose depends on their attitude to risk, expertise in the market, the diversity of their portfolio and how comfortable they feel about losing money. They should also never trade more than they can afford to lose.