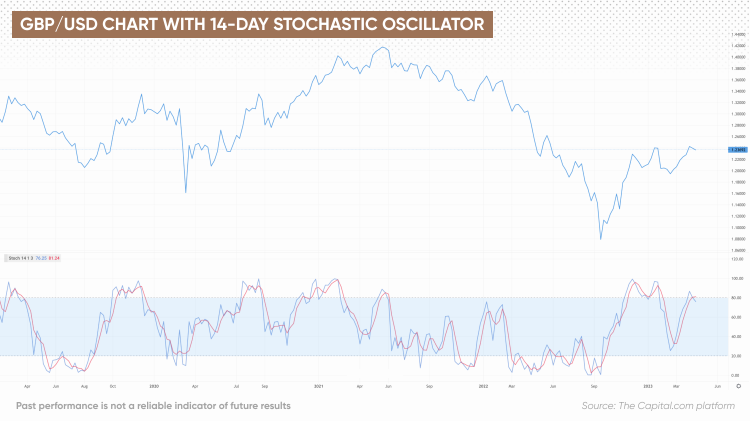

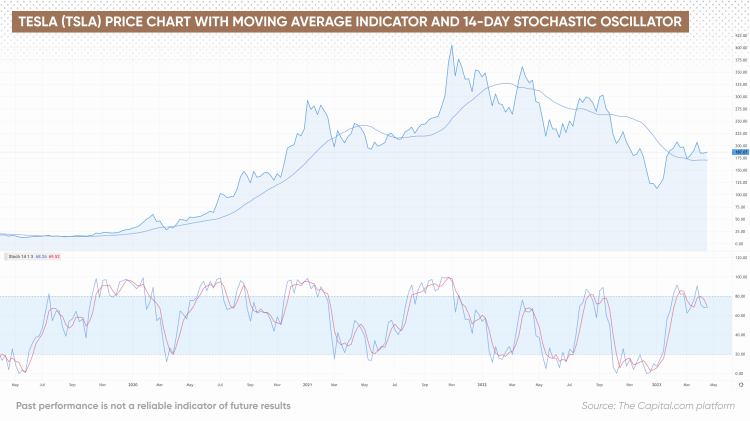

The stochastic oscillator is bounded between the 0 and 100 range and is displayed as two lines %K and %D.

The %K line is the measure of the price momentum, while the %D line is a moving average of %K.

The %D line is generally considered more important, as it produces more accurate trading signals.

The %K is calculated by taking the range of the current closing price and the lowest low, and dividing that by the total range of the market (highest high minus the lowest low), and multiplying this factor by 100.

The %D line is a (typically) three-unit period simple moving average of the %K line.

Applying stochastic oscillator strategy in trading

Traditionally, when %D falls below the 20 mark it suggests the market is oversold. Conversely, when the oscillator exceeds the 80 mark, the asset is considered overbought.

Divergences occur when a new high or low in price is not confirmed by the stochastic oscillator.

A bullish divergence occurs when price records a lower low, but the stochastic oscillator forms a higher low. This shows less downside momentum and could be foreshadowing a bullish reversal.

A bearish divergence forms when price records a higher high, but the stochastic oscillator forms a lower high. This shows less upside momentum and could foreshadow a bearish reversal.

The stochastic oscillator is useful for traders as it generates signals that indicate whether an asset is overbought or oversold. When assets are either overbought or oversold, it is expected that a price reversal may be imminent.

According to the strategy, the longer an asset is overbought, the more likely it is to go down in price, once the market realises that the price is inflated and not representative of the inherent security. On the other hand, the longer an asset is oversold, the greater the likelihood that the price will start a bull run. The stochastic oscillator could then be used to gauge when a price reversal is likely to occur.

Stochastic oscillator strategies

Moving averages