Using SAR with other indicators

It is essential to remain vigilant when using the Parabolic SAR, as it can generate false signals in range-bound or choppy markets.

To improve the accuracy of the indicator, traders may consider combining the Parabolic SAR with other technical analysis tools, such as moving averages (MA), the Relative Strength Index (RSI), the Moving Average Convergence Divergence (MACD), and more.

Parabolic SAR trading strategy

There are also some more advanced strategies of using SAR in your trading. Make sure to always conduct your own thorough research before using them.

Parabolic SAR breakout strategy

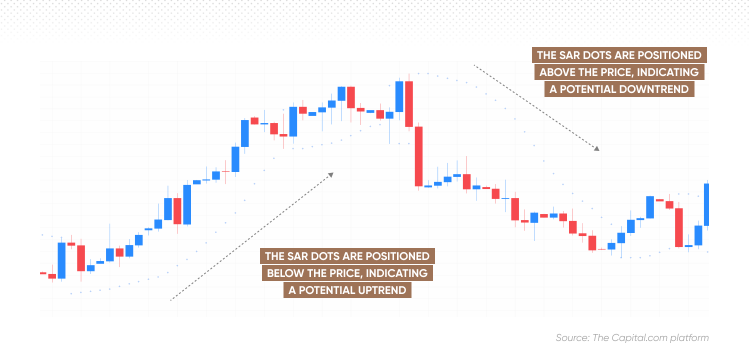

The Parabolic SAR breakout strategy combines Parabolic SAR indicator with the concept of breakouts in trading. This strategy aims to identify moments when the market’s volatility increases and the price moves beyond established support or resistance levels, signalling the potential for a strong trend to emerge.

To implement the Parabolic SAR breakout strategy, traders should closely observe the consolidation of the Parabolic SAR dots near the asset’s price, indicating a potential impending breakout. As the price breaks out of the consolidation zone and the Parabolic SAR reverses, traders may consider entering a long position if the breakout is bullish, or a short position if it’s bearish.

It may be useful to set appropriate stop-loss orders and take-profit targets. Note that ordinary stop losses do not protect from slippage, while paid-for guaranteed stop losses do. Traders may also consider using other technical indicators, such as Bollinger Bands or volume analysis, to confirm the breakout’s strength and validity.

Double Parabolic SAR trading strategy

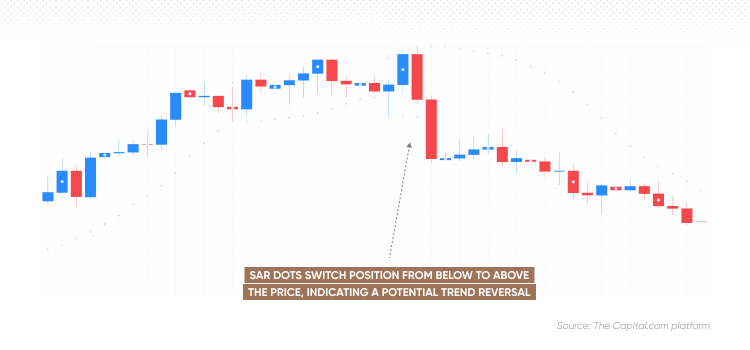

The Double Parabolic SAR strategy employs two distinct timeframes: long-term and short-term. Once the long-term trend direction is determined using the Parabolic SAR indicators, trades are executed using the indicator on a shorter time frame, but solely in the direction of the longer-term trend.

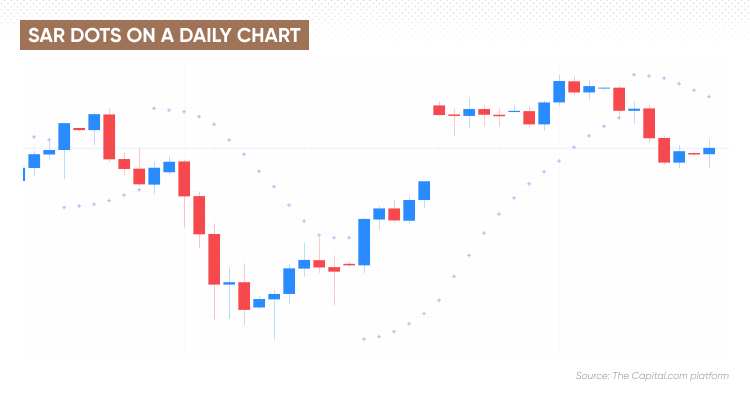

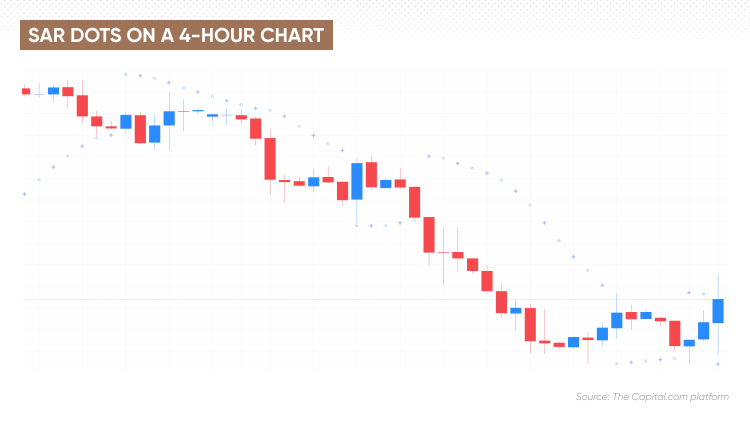

For example on the daily chart below we can see that in the past week the SAR dots have switched from below to above the price, and the price started reversing after the previous uptrend. This is a bearish signal, indicating a potential downward trend on the long timeframe.