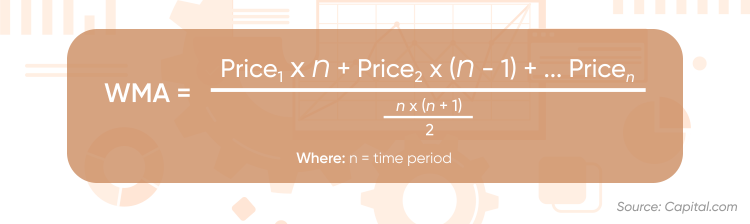

The weighted moving-average formula is calculated by assigning different weights to each of the data points in the series, with the most recent data point getting the highest weight.

This essentially converts the original prices to ‘weighted prices’. Then those new weighted prices are added up and divided by the number of periods to get the latest weighted moving-average value.

A popular type of Weighted Moving Average is the Exponential Moving Average (EMA). This indicator is available separately inside the trading platform.

Who invented the weighted moving average?

It’s unknown who first began applying WMAs to trading financial markets. Yet the invention of the moving average dates back to the beginning of the 20th century.

Mathematician R. H. Hooker published a famous work on time series analysis in 1901 and referred to what were essentially WMAs as ‘instantaneous averages’.

The phrase ‘weighted moving average’ was first coined in 1909 by Yule, part creator of the Yule-Walker moving-average model, when describing Hooker’s process.

Why is the weighted moving average useful for traders?

The weighted moving average offers an alternative to the simple moving average for traders looking to include the indicator as part of their trading strategy.

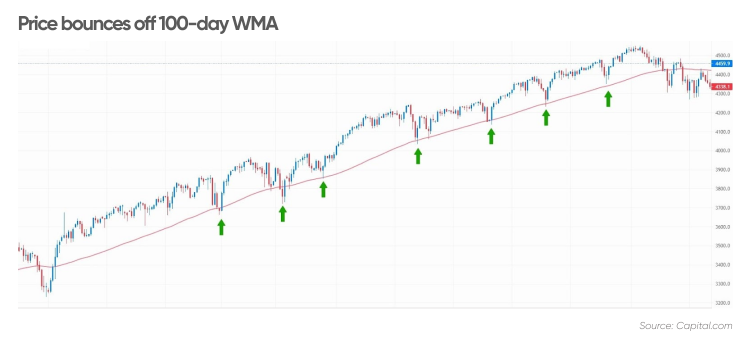

The weighted moving average method is a form of technical analysis that is used by traders to identify trends. Additionally, it can be used as a filter for price action and as an indicator of trend direction. It can also be used as a way to identify support and resistance levels on a chart.

The WMA can be used in conjunction with other indicators such as the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) to help traders make more informed trading decisions.

Smoothing

The weighted moving average smoothes out volatility in the raw price action, where volatile price moves over short periods can district traders from the bigger picture.

Instead of seeing big differences in highs and lows and opens and closes that are seen in candlesticks or bar charts, with a moving average there is only a single smoothed line.

Less lagging

The WMA is a trend-following indicator that does not lag behind price as much as others because it puts greater emphasis on the latest prices. This means that when prices are moving, it will move in the same direction more quickly.

This is different from the SMA, which will track the price but because it equally accounts for all the prices that are being averaged, lags behind more than the WMA.

Simple and adaptable

The indicator provides a simple way to identify trends, and it can be applied to any time frame without requiring complex calculations.

The weighted moving average can be used in a variety of financial and economic contexts, such as estimating future stock prices or how to trade forex.

How to interpret the weighted moving average

There are multiple ways traders can interpret the WMA. For example, identifying trend direction and strength, or the likelihood of a trend reversal.

Identifying trends

When the WMA line on the chart is pointing higher, it indicates an uptrend. Accordingly, when a WMA line is pointing downwards, it indicates a downtrend. If the WMA line is flat, it shows there is a sideways trend.