Heikin-Ashi candles were developed by Japanese rice trader Munehisa Homma back in the 1700s. Homma is considered by many to be the father of technical analysis for his work in identifying price trends.

Homma created the first candlestick charts and used them to identify definite trading patterns that formed ahead of changes in the direction of rice prices. Understanding the psychology driving price trends put him at an advantage to other traders, as he outlined in his 1755 book, The Fountain Of Gold: The Three Monkey Record Of Money.

How to read Heikin-Ashi candlesticks charts

Analysing Heikin-Ashi candles provides a way for traders to identify the start of major price trends and trend reversals by filtering out the day-to-day noise in the stock markets.

This is especially useful during periods of high volatility, when it may be easier to lose sight of longer-term movements. Traders could potentially use the charts to try to identify when to open or hold a trading position and when to exit ahead of a reversal.

The Heikin-Ashi indicators can be applied to any time frame – hourly, daily, monthly, etc. Combined with other technical indicators they could form a fuller picture of the direction of an asset price. Heikin-Ashi charts may be used to analyse forex and commodities, as well as stocks and indices.

Reading Heiken-Ashi candles may be relatively straightforward, but it is important for traders to understand how they work and what they represent if they intend to try and use them to make more informed trading decisions.

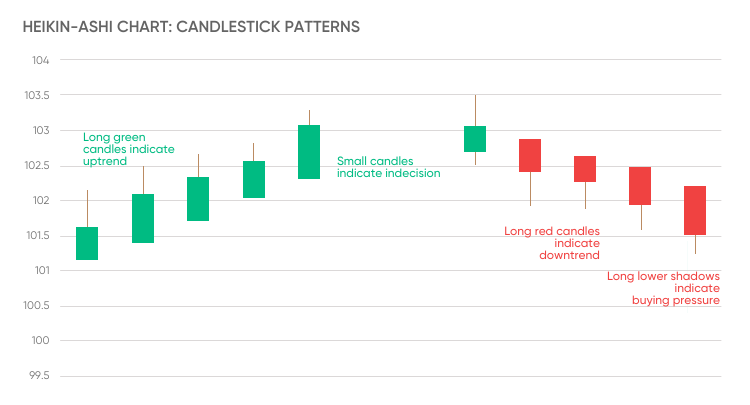

In an upward trending market, a Heikin-Ashi chart will show a progression of green, or other coloured, candlesticks with no lower shadow or wick. Conversely, in a downward trend, there is no upper wick on, typically, red candlesticks.

Heikin-Ashi trading strategies

Heikin-Ashi charts may be set with most charting software and platforms by simply selecting ‘Heikin Ashi’ as the chart type and choosing the desired data source and timeframe.

Charts showing candlesticks without wicks, or shadows, on the lower end signals the beginning of a bullish trend. When candlesticks have no wicks on the higher end, they indicate the start of a bearish trend. The longer the sequence of candles without wicks, the stronger the trend it signifies.

Candles with shorter bodies and longer wicks indicate that traders should be aware of a pause in the trend. The trend could then reverse direction, or it could resume its movement in the same direction. This requires some skill and experience to interpret which of those is more likely to happen.

When markets are changing direction and sentiment shifting, there is more volatility and candles resemble the dojis on traditional candlestick charts, with smaller bodies and longer wicks. As trends reverse, the candlestick colours switch.

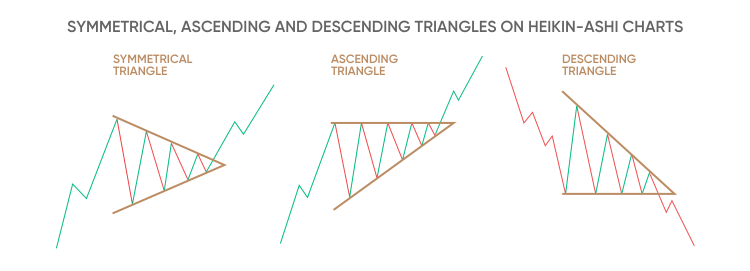

In addition to the candles, there are three kinds of triangles drawn on Heikin-Ashi charts: descending, ascending and symmetrical.

If candles break above the upper boundary of an ascending or symmetrical triangle, the upward trend is likely to continue, whereas if there are candles falling below the bottom of a descending triangle, the chart indicates a bearish trend.