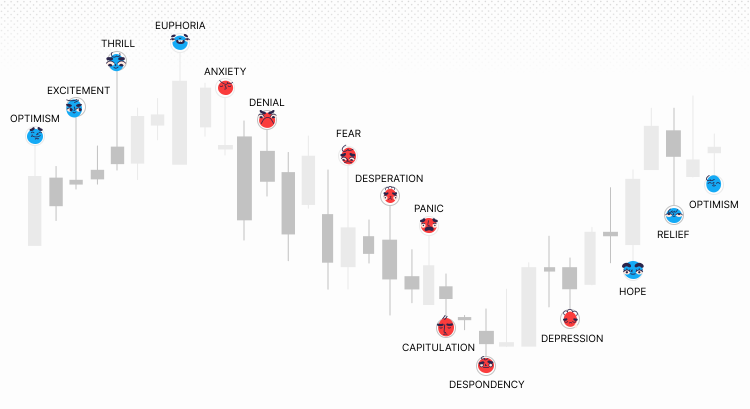

Let’s take a look at the key emotional points of a trader’s journey.

Euphoria

Euphoria, or the feeling of intense excitement or elation, could be provoked by a profitable trade, or a winning streak. While in the outside world euphoria usually has positive connotations, in trading it can be a double-edged sword and lead to a distorted perception of potential for significant gains.

In the state of euphoria traders could become more self-assured and fall prey to the overconfidence bias, taking more risk than they normally would. For example, traders may take a larger position than they are comfortable with, or use higher leverage, which magnifies both profits and losses.

Fear

In trading, fear could be triggered by unexpected market volatility. It could cause traders to become fixated on short-term losses, prompting them to base decisions on anxious thoughts rather than sound analysis. This could lead to a panic-driven sell-off, with traders closing positions or not opening positions at all.

Fear could also lead to paralysis, when faced with uncertainty, traders may become reluctant to act. This could be particularly damaging in fast-moving markets, where speed of response is essential.

Despondency

Despondency typically comes after the panic and capitulation stages are over, and a trader is left in the feeling of deep despair, with their confidence at its lowest.

Despondency could be caused by a significant loss or a series of losses. In fact, numerous studies have shown the damaging mental effects of financial worries, with some psychologists suggesting that a financial loss can trigger grief.

Traders in the state of despondency are more likely to become fixated on failures and lose self-belief, become more prone to the loss-aversion bias or give up trading altogether.

How emotions affect your trading decisions

Cognitive biases: Emotional trading could lead to a number of cognitive biases such as overconfidence and excessive risk-taking, or on the contrary, loss aversion and giving up on trading, just to name a few.

Impulsive decision-making: Impulsive decision could cause costly mistakes, lack of discipline and oversight, leaving traders potentially exposed to greater losses.

Loss aversion: Loss aversion could cause traders become fixated on short-term losses and avoid trading

How to control emotions in trading

Mindfulness and meditation. A growing number of traders are now embracing these practices to cultivate an increased awareness of their thoughts and emotions and trading based on rational decisions.

Journaling. Diligently documenting trade decisions, strategies, and emotional states may help traders in evaluating their performance, identifying patterns, and rectifying emotional biases.

Positive self-talk. Consciously replacing negative thought patterns with constructive, affirming statements could help traders in bolstering their confidence, maintaining composure and minimising the impact of emotional biases in decision-making.

Taking breaks. Periodic respite from the relentless stream of market data may allow traders to step back, recalibrate their focus and gain perspective on unfolding events, enhancing mental clarity and emotional control in trading.

Seeking support. Engaging with peers may provide an opportunity to exchange insights, discuss strategies, and share experiences, which in turn can help bolster emotional resilience.

Conclusion

Trading the financial markets is an emotionally-charged endeavour, with traders often experiencing a gamut of feeling, from euphoria to fear and despondency. Trading with emotions could lead to cognitive biases, impulsive decision-making, and loss aversion, all of which can adversely affect trading performance. To navigate the emotional rollercoaster, traders must be aware of their emotions and employ strategies to keep them in check.

A variety of methods could be employed to control emotions in trading. Mindfulness and meditation may help cultivate awareness and improve performance, while journaling may assist in identifying patterns and rectifying biases. Positive self-talk bolsters confidence and minimises emotional biases, while taking breaks allows traders to recalibrate and maintain clarity. Engaging with peers for support further may enhance emotional resilience.

In summary, acknowledging and managing emotions is essential for successful trading in the financial markets. By employing various tactics traders could mitigate the impact of emotions on their decision-making which may help to optimise their performance in the ever-evolving world of finance.