Consequences of confirmation bias

When it comes to trading, behavioural mistakes are common. Some, like confirmation bias, can be equally prevalent among retail and professional traders.

Warren Buffett famously said:

“What the human being is best at doing is interpreting all new information so that their prior conclusions remain intact”.

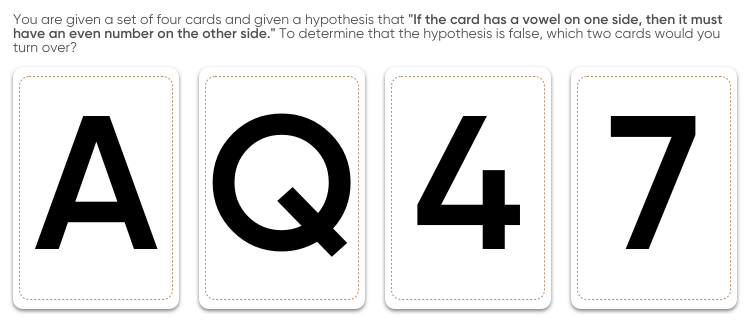

Because confirmation bias is a shortcut, allowing traders to make quick decisions, it could lead to them making obvious mistakes.

This is because traders often tend to gather confirming evidence when evaluating information, asking questions in a way where only an affirmative response is possible and ignore contrary data and quickly dismiss data confronting their investment thesis.

Confirmation bias could also lead to other known behavioural phenomena like overconfidence bias.

Overcoming confirmation bias

The biggest challenge of dealing with confirmation bias is acknowledging that it exists. Regardless of the evidence shown, if we are not aware, we are likely to interpret it in a way that supports our view.

Fortunately, once you acknowledge the concept, several strategies may help to keep the confirmation bias in check.

Thinking about possible issues with your existing trading thesis and making a list with different potential outcomes could help internalise the information objectively. Building an alternative investment case then could help you to collect and interpret data in a less biased way.

You may also be less likely to reject contradictory information without consideration in the future. Understanding the critical negative, as well as positive, drivers of any trade can improve the trader’s awareness of the downside risk.

Actively seek out people and news sources with alternative opinions. In 2013, for example, Warren Buffett invited hedge fund manager Doug Kass to participate in the annual Berkshire Hathaway meeting, giving voice to a view that contradicts his own. Kass was a critic of Buffett’s investment style and had a short position in the stock.

It may also be useful to adopt a contrary viewpoint, and argue the opposite side for the sake of argument. While doing this, avoid asking questions that are likely to confirm a pre-existing notion.

According to research by Jennifer Lerner and Philip Tetlock, people are more likely to think critically when held accountable by others. We are less likely to exhibit confirmation bias if we have to justify our decisions and actions. This is driven by our desire to avoid negative feedback or perception rather than an attempt to be more accurate.

One of the ways of dealing with confirmation bias is to use technology that can process information in an unbiased way. They could help traders form an impartial view and overcome cognitive biases.

Ray Dalio, a founder and former chief of Bridgewater Associates, is a known proponent of technology and algorithmic investment decision making. His firm uses algorithmic decision-making in many areas of their company, not limiting it to just investment decisions.

Conclusion

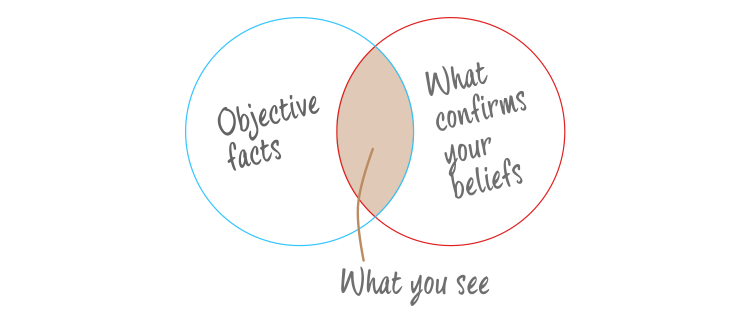

Confirmation bias is a type of cognitive bias that leads people to only seek out information that confirms their pre-existing beliefs, sometimes actively ignoring evidence to the contrary.

In trading this can often lead to traders searching for confirming evidence and dismissing data confronting their investment thesis. This could potentially lead to heavy losses, which is why traders should consider taking steps to avoid this bias.

Methods for avoiding confirmation bias could include making use of existing technology, which can process information in an unbiased way. Traders could also consider actively searching for information that could disprove their existing thoughts and ideas.

As always, traders should make sure to do thorough research before making any trading decision, taking into account their attitude towards, knowledge of markets and existing portfolio, among other factors. They should also never trade with more money than they can afford to lose.