On the contrary, traditional share trading involves buying shares of companies for their market value through regulated exchanges and brokers. It can potentially require more capital – using the example above, you would have to pay the full $1000 to buy the shares in question outright, as no leverage is involved.

Share dealing can be used as a more long-term approach, where the investor expects the price to rise over a time frame of months to years. CFD trading, meanwhile, tends to be considered a short-term investment, where traders open and close positions within days or weeks, partially due to overnight fees involved.

Let’s break down the key similarities and differences between CFDs and share dealing.

CFDs vs Stocks trading: Key similarities

Risk: Both CFDs and stock trading carry a risk of a loss. Make sure that you do your own research, remember that prices can go down as well as up, and never trade with more money than you can afford to lose.

Liquidity: Both stock and CFD trading are relatively liquid, meaning that both instruments are comparatively easy to both buy and sell.

Locations available: Both CFDs and share dealing are available to traders globally.

CFDs vs Share dealing: Key differences

Type of instrument: CFDs are derivative instruments, while share dealing involves owning underlying stocks.

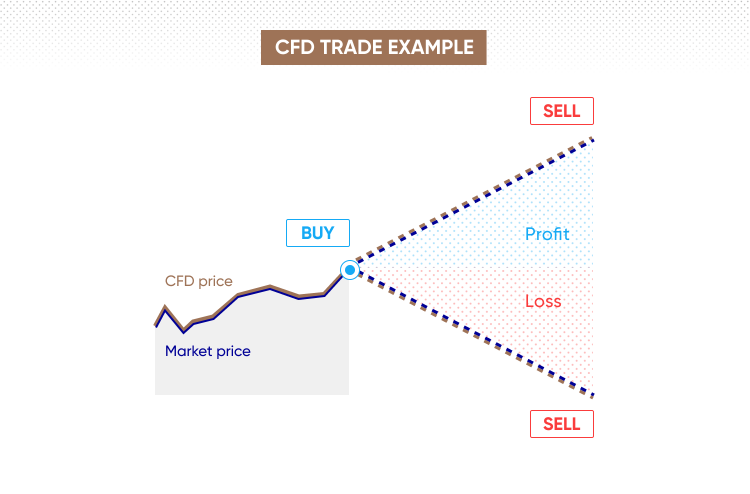

Going short: Trading CFDs allow speculation on a price downtrend by opening a short position, while share dealing only allows going long.

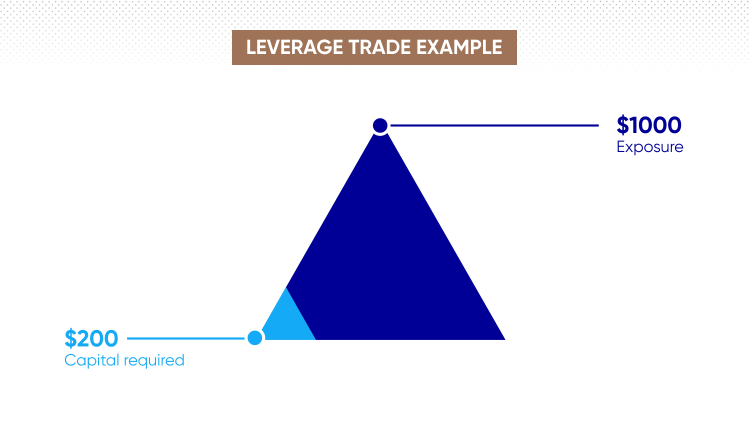

Leverage: CFDs allow the use of leverage, which means traders can open larger positions with less funds. Note that leverage can magnify both profits and losses.

Out-of-hours trading: Stock trading is only available whenever the corresponding exchange is open. CFD trading is sometimes available out-of-hours, depending on a broker.

Asset classes: CFDs offer access to a much broader range of asset classes than share dealing. For example, you can also trade foreign exchange (FX), commodities, indices and more via CFDs.

CFD vs Share dealing: What instrument to choose?

The key difference between CFD trading and share trading is that with a CFD you don’t take the ownership of the underlying stock – you just speculate on its price movements, whether upward or downward.

Another vital difference between taking a position with a CFD and purchasing shares is the ability to make leveraged trades. CFDs are traded on margin, which means that a trader can open larger positions relative to the amount of initial capital they have. Leverage can magnify either profit or loss, meaning it comes with a high risk of losing or gaining money rapidly.

It’s worth noting that there are risk-management tools available for traders. For example, stop-loss orders, which close a losing position at a predetermined price level, to limit further losses. Note that regular stop-loss orders, however, do not always protect from slippage. Guaranteed stop-losses prevent slippage, yet they come at a fee. There are also take-profit orders that close a winning position at a specified price level to book profits before the price trend reverses.

Remember to carry out thorough research of the markets based on numerous reputable sources (analyst overviews, media reports etc.) before opening a position, and never trade more than you can afford to lose.

When comparing CFDs vs shares dealing, you can find that both types offer different ways to take advantage of price movements in financial markets and both can become a part of your portfolio. It is entirely up to the trader to decide which instrument is more appropriate for them. With share dealing traders may apply a more both short-term and long-term trading strategy (for example, position trading) while with CFDs shorter-term strategies such as day trading are more common due to overnight fees.

Why trade CFDs?

Leverage: You can trade CFDs on margin, putting down a fraction of the value of the stock position, borrowing the remaining capital from the broker. Leverage provides traders with greater market exposure with a smaller deposit, however, it can also magnify both profits and losses.

Hedging: Traders can short-sell when CFD trading, which can be a useful instrument in a hedging strategy.

Short-term trading: CFDs can be used to capitalise on price movements in the short term.

Wide range of markets: CFDs allow you to choose and speculate on the price movement on equities, commodities, indices, currency pairs, and more asset classes.

Offsetting losses against profits: You can potentially use CFDs losses to offset against profits when paying your tax bill. Note that tax treatment depends on individual circumstances and can change, or may vary in different jurisdictions. Please seek out a tax professional for tax advice.

Why trade shares?

Ownership privileges: Owning stock gives you shareholder privileges, such as voting rights on major company issues and dividend payouts

Invest long-term: While share dealing can be used for short-term market volatility, it’s often used as part of a long-term investment strategy, allowing you to adjust your holdings accordingly in line with market fluctuations

Limited risk: Your potential losses are limited to your initial investment when no leverage is used.

Conclusion

Ultimately, it is down to the individual trader to decide which instrument will best fit their risk profile and trading objectives.

While CFDs can offer you access to a broader range of markets for a low initial outlay, this comes with risk, as leverage is involved. Share ownership however comes with its own set of benefits, such as voting rights in a company and potential dividend payouts.

In deciding which instruments to include in your portfolio, remember to do your own research, looking at the latest news, fundamental and technical analysis and a wide range of commentary. Note that prices can, and do, go down as well as up, and make sure to never invest more money than you can afford to lose.