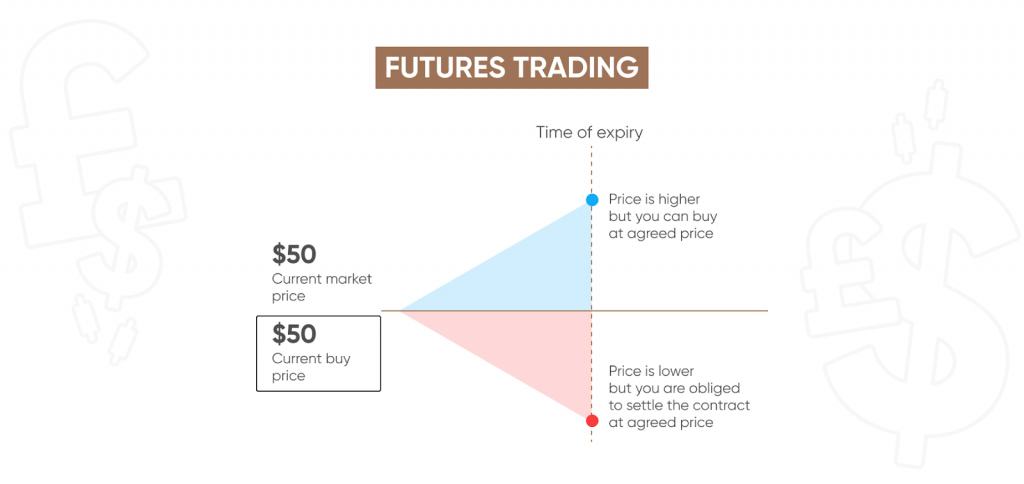

If the value rises the person buying the future gets a good deal and the person selling loses out. If the price falls, then the person selling has the better end of the bargain, while the person buying gets the worse end.

CFDs and futures: Five key similarities

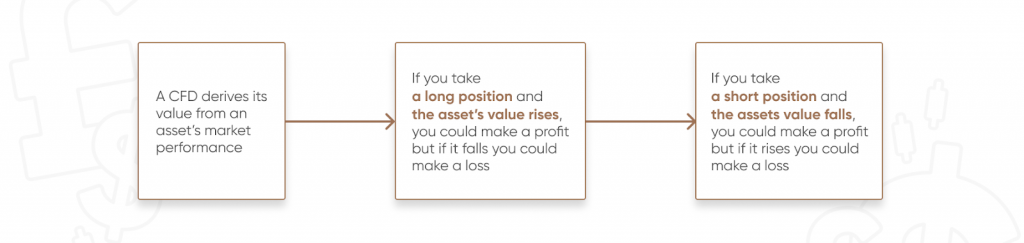

The main similarity between CFDs and futures is that they are both derivatives. This means that you don’t actually own the underlying assets, but rather something that derives its value from them. This means both instruments can derive from a number of securities, and in fact you can actually trade CFDs on futures with some providers.

However, there are other things that CFDs and futures have in common:

Risk. Both CFDs and futures carry a lot of risk. So make sure that you do your own research, remember that prices can go down as well as up, and never trade with more money than you can afford to lose.

Variety of markets. There are futures available for a wide variety of markets and asset classes, such as stocks, forex, indices, commodities and interest rates. Likewise, contracts for difference are related to a whole range of different assets, such as forex, indices, stocks and commodities. So a forex trader, for example, could be choosing between currency futures vs CFDs on currency pairs.

Hedging. Both CFDs and futures can be used for hedging, meaning that people can use them to potentially minimise losses if the markets go against them.

Liquidity. Both futures and CFD trading is relatively liquid, meaning that they are comparatively easy to both get into and go out of.

Derivatives. Both futures and CFDs are financial derivatives, meaning that when traders buy them, they don’t own the underlying asset itself, but something that derives its value from it.

CFDs and futures: Five key differences

There are, however, multiple differences between CFDs and futures. One of the most important ones is that futures have a set date for completion which will, ultimately, come with a set price. On one hand, this means that trading in futures can be more transparent than CFDs. On the other hand, this means that CFDs can be more flexible.

Other differences include:

Leverage. The use of leverage, or borrowing money in order to get more access, or exposure, to a market is commonplace with CFDs, but it less common, although still possible, with futures. Note that leverage can magnify both profits and losses.

Physical assets. Buyers who keep their position in a future contract beyond the due date should be ready for a physical delivery of an underlying asset if it exists in physical form, while CFDs are purely hypothetical. For example, traders comparing oil CFDs vs futures in the commodity should keep that in mind.

Contract sizes: CFDs always trade per contract, while futures’ contract sizes vary. When deciding on an instrument, stock traders, for example, can choose between single stock futures vs CFDs on stocks.

Flexibility. CFDs can be more flexible and can operate on a short-term basis, while futures can be more of a longer-term investment.

ETFs. Futures can be traded as part of an exchange traded fund (ETF), designed to track a particular group of assets.

CFD vs futures: Which instrument to choose?

Whether you prefer trading with CFDs or with futures will depend on a range of things, including your risk tolerance and knowledge of the markets. You should also make sure to keep up with market developments, as well as review and improve your trading strategy on a regular basis.

Why trade CFDs?

Liquidity. CFDs are liquid, and can be bought and sold with relatively little fuss.

Leverage. Leverage allows you to borrow money from a broker, which can give you more access, or exposure, to a market. This can lead to making greater profits but can also result in heavier losses, so be careful.

Go long or short. You can get a CFD based on whether you think a market will go up or down

Why trade futures?

Go long or short. You can buy a futures contract if you think that the price of the asset will go up, or sell one if you think the price will go down.

ETFs. Futures are available as part of an exchange traded fund, or ETF.

Possibility for hedging. As futures allow to go short as well as long, traders can use them to hedge other positions in the same asset.

In conclusion

Something we need to mention is that CFDs and futures can both encompass a wide range of underlying markets. So when it comes down to CFD trading vs futures trading, traders in fact can work with both. Indeed, it is possible to work with CFDs on the futures market, meaning that you can trade based on whether you think a future’s value will go up or down over time.

Before every sensible trader decides what to trade on, they do their own research, looking at the latest news, fundamental and technical analysis and a wide range of commentary. They also remember that prices can, and do, go down as well as up, and they also make sure to never invest more money than they can afford to lose.