Swing trading

With swing trading, traders aim to find a possible price trend and then hold an asset for a period of time – from a minimum of one day to several weeks – in an attempt to make a profit.

Again, this strategy will need the markets monitored and technical analysis made. Swing trading is so called because it is based on waiting for price changes, or swings. Swing trading is used as a medium-term strategy.

Position trading

Position trading, also known as Trend trading, is a CFD trading strategy in which a trader holds on to a CFD for a longer period of time and closes the position when the time is right. This involves monitoring an asset’s performance, and also requires patience and, in many cases, paying holding fees.

A potential disadvantage of this holding an open position for long periods is having to pay overnight fees. Position trading is seen as a more long-term strategy.

News trading

This strategy is based on keeping an eye on breaking news in the financial world and using that knowledge to predict markets’ likely moves and inform trading decisions.

It can include looking at economic and corporate reporting calendars; positive company quarterly financial statements may boost the stock up, while a disappointing balance sheet can hurt the price. Similarly, positive or negative economic readings and central banks’ announcements may shape investor sentiment.

Fundamental analysis can help traders learn more about how financial news may influence asset prices.

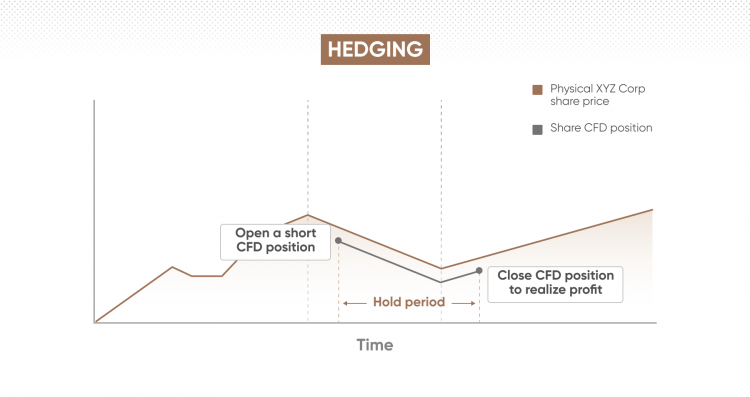

Hedging

When it comes to trading, a CFD strategy some people like to use is hedging. In this case, CFDs are used to mitigate against potential losses from holding underlying assets.

Let’s say a trader owns shares in a company, but the latest quarterly report shows disappointing financial results. Theoretically, they could take out a short position on a CFD in the company’s shares so that even if the value of the stock goes down they can potentially mitigate losses by profiting from the short CFD trade.

However, if the asset does not perform in the expected manner, the trader could end up losing even more money than they otherwise would have.