Chapter 1: What is a CFD?

A CFD is a derivative that allows you to trade the price of a stock, asset or other financial product without actually having to own the underlying stock or product.

Trading CFDs works very simply: you decide to buy a CFD based on the price of Brent Crude oil (let’s say it’s current level is $50 a barrel) because you expect Brent to increase in price. At the termination of the contract, the seller of the CFD will pay you the amount it has gone up by. For example, if it has risen to $55 a barrel, the seller pays you $5 per CFD that you own.

We’ll look at how you trade in more detail later on – but let’s first run through the products on offer.

Chapter 2: What are my choices?

Good question. CFDs can be offered for an incredible variety of financial assets or products. The most common ones include:

Commodities – such as energy products: oil, gas; industrial metals: copper, aluminium; precious metals: silver, gold; agricultural products: coffee, wheat and so on.

Shares – many individual share prices from companies listed on stock indices around the world are likely to be on offer.

Indices – stock index levels can be traded for domestic and foreign indicators such as the FTSE 100 in London or the S&P 500 in New York.

Currencies – these are exchange rate levels, such as the UK pound against the US dollar: usually these are indicated by currency codes, so the pound vs dollar is expressed as GBP/USD, euro vs yen is EUR/JPY and so on.

The list goes on. Many other financial products, such as (ETF), can also be offered as CFDs. Quite simply, as long as something has an indicator or price level that responds to trading volume, it can be linked to a CFD.

Trading tip 1: Know your market

It’s a rule that any good trader would live by. Before you spend any money on investments or financial products, learn something of the market you’re getting into. For CFDs, this means you must get to know the ‘underlying’ market of the CFD you’re buying. Look at the charts (these are freely available on websites like Bloomberg, Reuters, FT.com, Google Finance, etc.), read the financial news, find out about the market’s recent history and what makes it tick.

Chapter 3: How does CFD trading work?

Say you’ve decided the best way into a particular market is through CFDs. What’s the first thing to do?

Seek a dealer you can trust. There are many financial firms offering CFD services and you can do a lot these days using an online trading platform.

Before you start you’ll have to set up a margin account. ‘Margin’ is like a deposit on your trades. On top of this, brokers will allow a certain amount of ‘leverage’ – or loaned financing.

With leverage, you are essentially borrowing money from the broker for additional purchases. This will help boost your investment capacity, as will become clear below (see Exercise 1), but it comes with some added risk.

When buying a CFD, you are speculating on whether the price of an asset will rise or fall. This is called positioning. If you’re backing a price rise, you are taking a ‘long’ position. Conversely, betting on a fall in the price is called taking a ‘short’ position.

Exercise 1. The benefits of leverage

Let’s take a look at one of the most popular shares in the US – Apple Inc.

You believe the shares will rise in price, so decide to take a long position.

Exercise 2. Using the stop loss

Now let’s look at index trading, one of the most popular forms of CFD trading.

Let’s say you’ve been doing your research, and this has been a good month so far for the FTSE. You decide on a long position.

Exercise 3. Taking a short position

The only difference here is that you are now speculating on an asset price going down. In market terminology, you buy long and you sell short. This time, let’s sell gold.

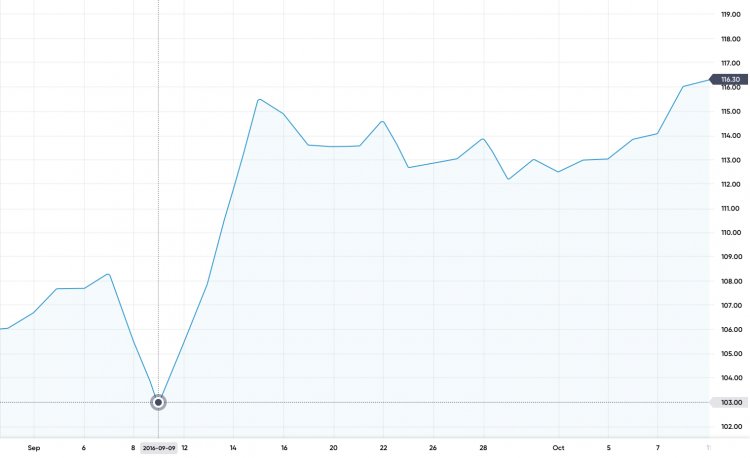

Opening your position: Your broker offers you an opening position of $103 on September 9 and you decide to buy 100 CFDs. At 100% margin, you’d have to deposit (100 x $103) = $10,300, plus a commission charge for transaction costs – maybe 0.1% ($10.30). There may be other costs involved, such as overnight financing charges. Remember to look carefully at the full costs of your transactions before you enter.

As you can see at 100%, the margin you’d have to provide is eye-wateringly high. If your broker instead accepts a 10% margin, you’d deposit only $1,030. A 5% margin would be $515.

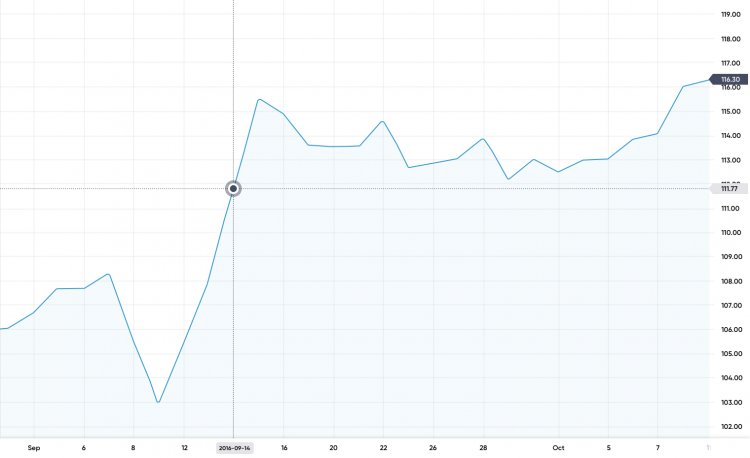

Closing your position: On September 14 you decide to close your position and take profits as the shares have risen in price to $111.77. That’s $8.77 per share, or a total profit of $877. You may also get charged commission on closing out your position.

Trading tip 2: What’s in the news?

When investing in any individual share, keep up with any developments of that company in the press – quarterly profit statements, AGMs, critical reaction to new product developments or boardroom changes. All these things, and more, can be a guide to future share price performance.

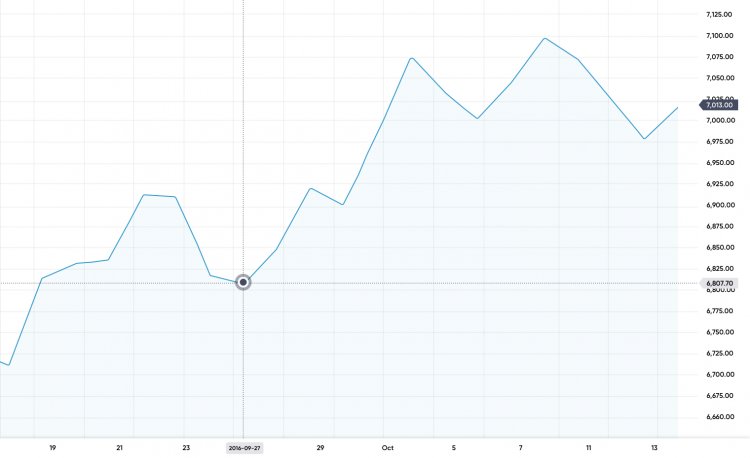

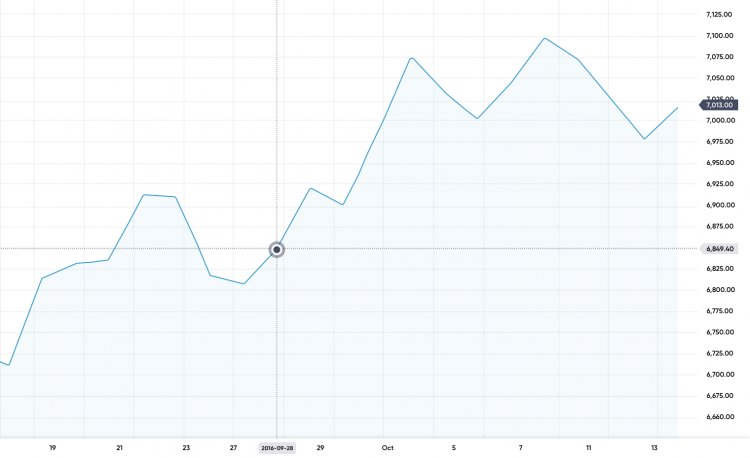

Opening your position: Your broker offers you an opening position of $6,807.7 on September 27 and you decide to buy 10 CFDs, which at 100% margin would cost a whopping $68,070. You pay 5 per cent margin (10 x 6,807.7 x 0.005) = $340.39

Closing your position: The next day, the FTSE 100 has risen 41.7 points to 6,849.4. Your 10 CFDs are now worth $68,494, giving you a profit of (68,494 – 68,070) = $424.

Warning: You’ve taken a long position, hoping that prices will rise. But if the index actually falls by the same amount – to 6,766 – your margin will not be enough cover the losses. The broker will then issue a ‘margin call’. This means you either have to put up additional margin, or close the position and pay him any excess.

To avoid putting too much pressure on your margin, you can set up a ‘stop loss’. This means that you can set a level at which your position automatically closes if the trade goes the wrong way.

Setting up your position with a stop loss: You’re still buying 10 CFDs at 5% margin on an opening position of 6,807.7. The margin you need to provide remains $340.39, as above. But this time, you include a stop loss at 6,773 on the FTSE which would halt any potential losses at $340 – just inside your margin – and close out the trade.

Trading tip 3: Cut your losses

Don’t hold on to a losing trade because you have a gut feeling it will turn around. And NEVER add margin to a losing trade. No one likes being wrong – but just accept it and move on.

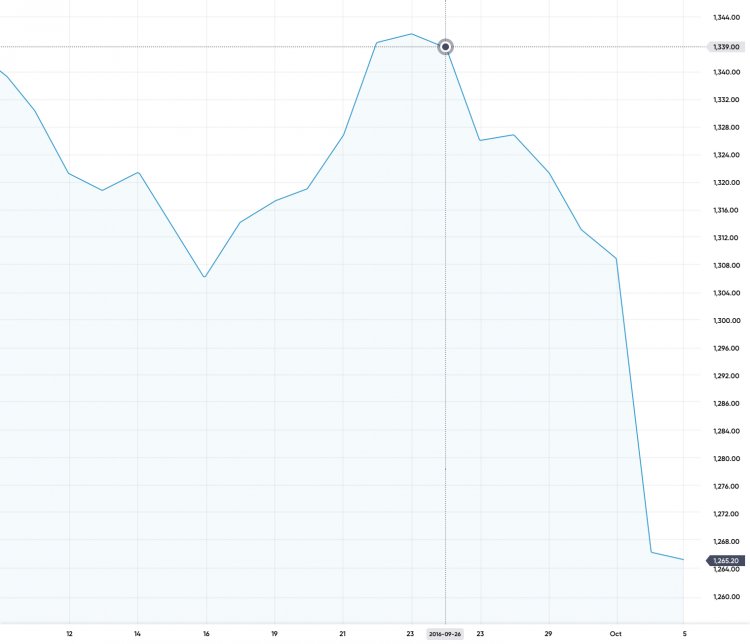

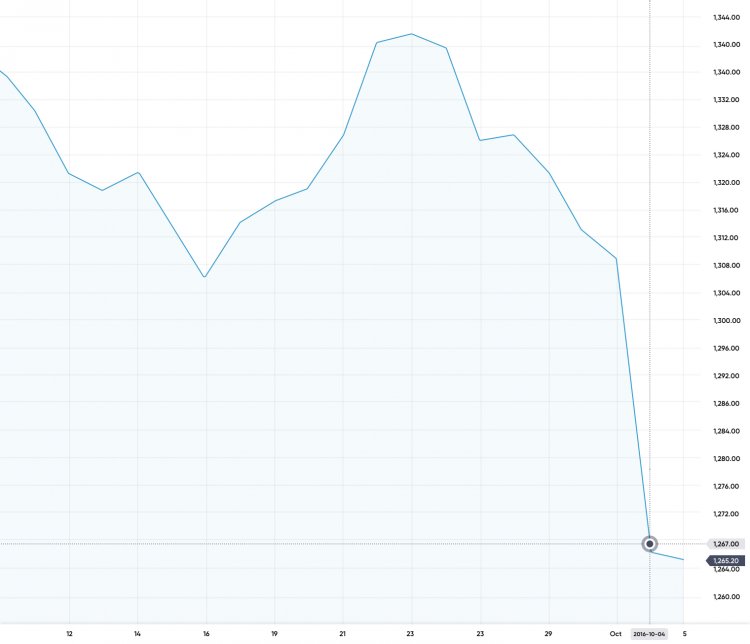

Opening your position: You opt to sell 10 Comex gold futures CFDs offered on September 26 at $1,339. Posting 5% per cent margin will cost (10 x 1339 x 0.005) = $66.95.

Closing your position: You hold on to your position until October 4, when the price has dropped to $1,267. You’ve traded well – you have gained ($13,390 – $12,670) = $720.

Trading tip 4

Each exercise above deals with a different asset class, and you should bear this in mind when trading. Don’t expose yourself too much to single trades. By diversifying your portfolio, no single mistake or event is likely to wipe you out. Understand the risks you are taking, and never risk more than you can afford.