As you can tell by looking at the image, the ATR does not exactly mirror the price. However, it does show when the price would have been the most volatile. Indeed, if we look at the chart, we can see that, when the asset was at its highest price, it had something of a mid-range amount of volatility.

Something else worth noting is that the Average True Range is written as an absolute value, rather than as a percentage. This means that an asset that is hovering around that $1,000 mark will have a higher ATR than one which is worth somewhere in the region of $10.

As a result, the first could register a more notable change in its ATR by rising by $100 than the second would by $5, despite the first asset going up by 10% and the second by 50%. Traders should be aware of this and not use ATR measurements in isolation when devising their Average True Range strategy.

ATR trading strategy: How to use ATR in trading

The Average True Range is a tool which could, potentially, help traders when they develop a trading strategy.

Day trading: It is not uncommon for the ATR indicator strategy to be used by day traders. The idea is to use short time periods to assess the ATR, and then to add that to a closing price.

Range trading strategy: The ATR can be used to work out a range trading plan. Since range trading relies on finding a particular range in which to trade in, using the ATR to measure the market’s volatility can help when it comes to knowing what sort of range to trade in.

Breakout strategy: Using an ATR trading strategy can be useful when combined with a breakout strategy. This means that a trader can use the indicator to see when an asset breaks out of a low volatility level, since this often precedes a sharp movement in price.

Momentum trading: Using the Average True Range indicator can, be informative when it comes to momentum trading. The ATR would typically rise when an asset’s price is likely to move quicker than before, which can lead to a momentum – either bullish or bearish.

How to use ATR to set a stop-loss and take-profit

The ATR indicator is often used in conjunction with stop-loss orders. Stop losses are market orders that would exit a losing trade at a predetermined price. Note that ordinary stop-losses do not shield from slippage – in this case, guaranteed stop losses may offer more protection, yet charge a fee.

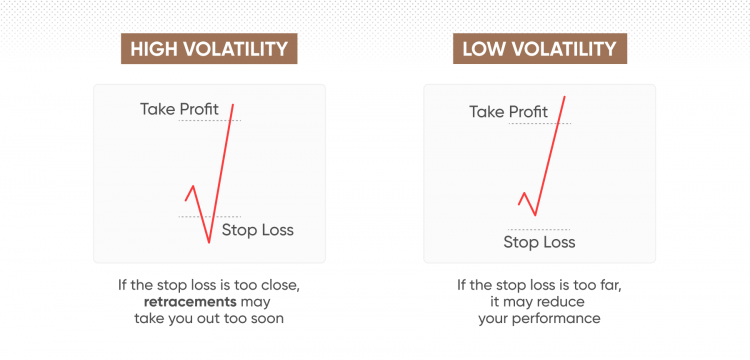

When the ATR is high, traders could potentially be prepared for greater volatility and wider price fluctuations. As a result, they could set their stop loss orders higher, because they might well think that price changes are to be expected, and that the market could, potentially make a recovery.

On the other hand, when the ATR indicates lower volatility, traders may use a smaller stop loss figure, because they could predict there may not be that much of a likelihood of a quick recovery from a market low.

Likewise, ATR can be used to set take-profit orders, market orders to close a winning position triggered at a predetermined price. When the volatility is high, traders may want to set the take profit order higher, because there is the possibility that the market could continue to rise and, similarly, when the volatility is low, then they may consider setting it lower because it is possible that the market may not continue to move upwards as much.