Support and resistance

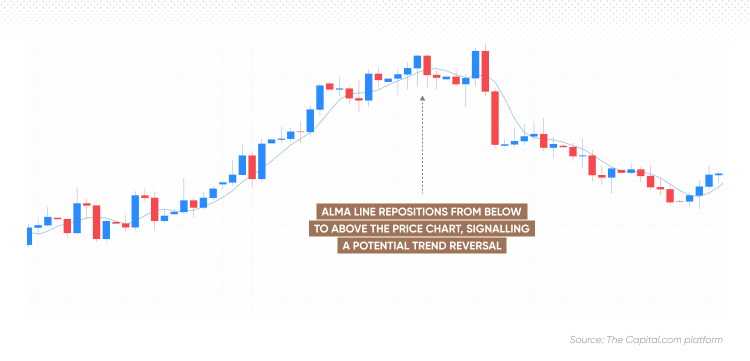

The Arnaud Legoux Moving Average can also serve as a dynamic support and resistance as it can adapt to changing price action.

When the price is above the ALMA line, it may act as a support level, suggesting that the price could bounce off the line and move higher. Conversely, when the price is below the ALMA line, it could act as a resistance level, indicating that the price might face downward pressure and could reverse lower.

Traders who follow this strategy may consider a long position when the price approaches the ALMA line from above, treating it as a potential support level. Similarly, they could consider a short position when the price approaches the ALMA line from below, treating it as a potential resistance level.

Combine with other indicators

The Arnaud Legoux Moving Average can be combined with other moving averages with different calculation methods and timeframes to enhance trading strategies and potentially enhance the quality of the signals.It can also be used in conjunction with other indicators such as Relative Strength Index (RSI), Parabolic Stop and Reserve (SAR), and Bollinger Bands to confirm a trend and determine its strength.

ALMA and EMAs trading strategy

The strategy combines the benefits of ALMA’s smoothness and responsiveness with the more traditional EMA, enabling traders to capture the best of both worlds.

To set up this ALMA strategy, you will need to plot three moving averages on your chart: the long-period ALMA (for example for 100 days) and two short-term EMAs (for example for 10 and 15 days).

In this ALMA indicator strategy, the ALMA serves as the primary trend filter, dictating whether long or short positions are taken when the price is above or below the ALMA. The 10 and 15-day EMAs are incorporated to provide bullish or bearish crossover signals.

For example, when ALMA is below the price, combined with a 10-day EMA crossing over 15-day EMA, this can be considered a bullish signal. Conversely, when ALMA is above the price, and 15-day EMA is crossing over the 10-day EMA, this can be considered a bearish signal.

ALMA crosses below the price chart, while the 10-day EMA crosses above the 15-day EMA, indicating a potential bullish uptrend