Some types of investing include, but are not limited to:

Value investing: Involves assessing the valuation of an asset and whether it is undervalued or overvalued to buy the so-called value stocks.

Growth investing: Involves targeting growth stocks, companies that are known for generating revenue and profits faster than the industry average.

Income investing: Buying assets that could generate income without selling them, for instance, through shareholder dividends.

Differences between investing and trading

| | Trading | Investing |

| Timescale | Short-term | Longer-term |

| Goals | Short-term profits | Longer-term profits |

| Risk | Higher risk | Can have less risk, but is still inherently risky |

| Return generation | Buying and selling assets | Can also involve shareholder dividends |

| Liquidity | Requires high liquidity | Less likely to require high liquidity, although some liquidity is needed |

| Ownership of the asset | Not in case of derivatives | Yes |

| Going short | Allowed with some derivatives | Only through selling assets or inverse exchange traded funds (ETFs) |

| Leverage | Allowed with some derivatives | Only through leveraged ETFs |

Timescale & Goals: Investors buy their assets and then hold onto them for a long time, cashing in, in many cases, many years down the line. Hence an investor’s goals are typically long-term profits. Trading, on the other hand, is a more short-term activity. A trader will not only evaluate what to buy or sell, but when to buy or sell it. The idea is to try to make a profit in a relatively short space of time.

Risk: Due to its long-term nature, investing may allow market participants to ride out short-lived high volatility and bear markets. Traders, on the other hand, could risk losing out more and sooner because they operate in a shorter space of time. Nevertheless, that does not mean that investing is without risk, as there is always the possibility of losing money.

Returns: Traders aim to generate income through buying and selling assets or financial derivatives in the short-term. Investors have other opportunities for income, for example through shareholder dividends.

Liquidity: Traders require a higher degree of liquidity to enable them to quickly enter and exit positions. On the other hand, investors may not require the same level of liquidity as traders since they are not necessarily looking to make frequent trades or enter and exit positions quickly.

Ownership of the asset: Investing typically involves ownership of the underlying asset, for example company shares. Trading, on the other hand, may involve buying and selling derivatives, such as future contracts or CFDs.

Going short: Some derivatives, such as CFDs, offer traders to open a short position, speculating on an instrument’s price to fall. In investing, however, going short can only be done through selling the asset if you already own it, or through inverse exchange-traded funds (ETFs).

Leverage: With CFDs, traders can also use leverage, which allows them to open bigger positions with less capital. For example, with 2:1 leverage, traders can buy $1,000 worth of CFDs with only a $500 payment. This involves more risk, as leverage magnifies both profits and losses. In investing, leverage is only available through leveraged ETFs.

Trading vs investing examples

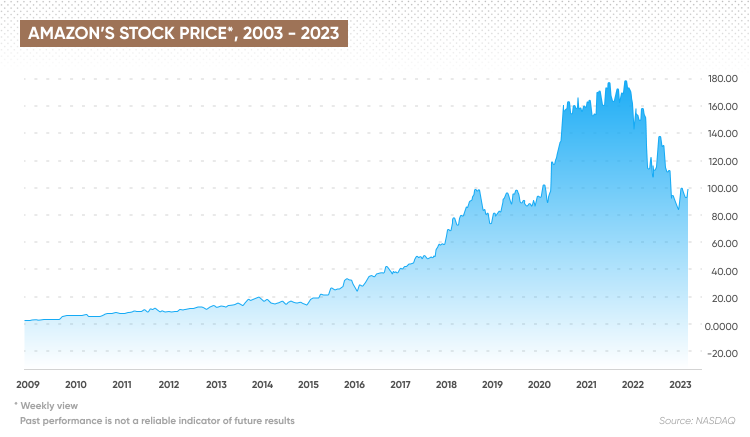

Both trading and investing can lead to profits, but also losses, depending on a range of unpredictable variables. Below, we look at some examples of how each approach may have led to different scenarios.

Remember, however, that past performance is not a guarantee of future returns.

Credit Suisse (CS) has seen its share price collapse over the years, as the troubled bank struggled with scandals, losses and liquidity problems. Between 2013 and 2023 the bank’s stock slumped by over 86%. The loss goes as high as 95% from when the share price peaked in 2007.