British banknotes and coins photographed directly above. The coins are in a stack, placed on top of the banknotes. Source: getty images

The UK economy will be in focus this week as two crucial pieces of data will be released. First, on Wednesday morning at 7 a.m., the Office for National Statistics (ONS) will release the August jobs data, including the unemployment rate.

But likely of more importance for markets will be the average earnings index which measures the change in salaries in the month. An increase in this index – from the current 7.8%, or 8.5% if bonuses are included – would mean that employees have demanded more compensation for their work.

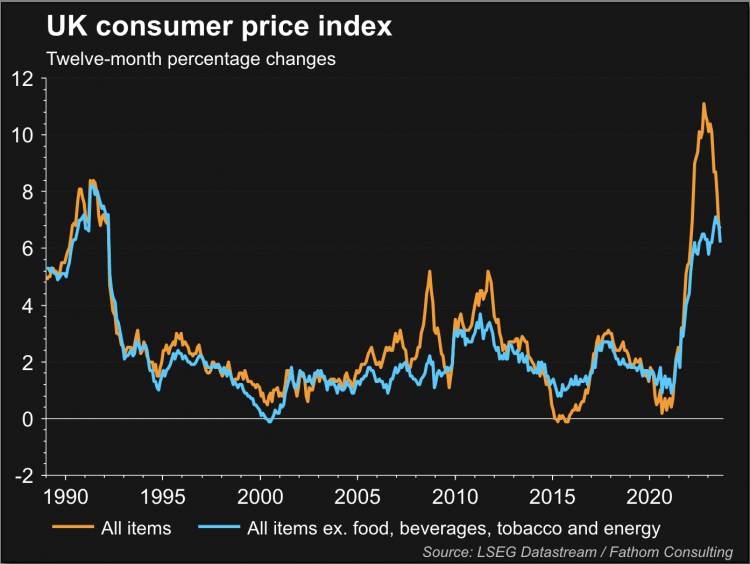

And what does this mean for the UK economy? Well, unfortunately, it wouldn’t be good news. In theory, a rise in earnings is a good sign as it gives a picture of a healthy and growing economy, but at present it will only add more fuel to the “inflation fire”. This is because the Bank of England (BoE) has been struggling to keep inflation under control, so a rise in wages is likely going to make them feel more concerned than they already are.

UK CPI. Source: reuters

A rise in consumer inflation (CPI) is normal after a recession – even if it is an uncharacteristically short one like what we saw during the beginning stages of the pandemic. As consumers start to spend more, prices go up. The issue arises when this cycle picks up too much speed, at which point prices rise exponentially and the economy starts to overheat. Even more concerning is when this happens alongside a drop in growth and consumer spending. This is where we are now, and unfortunately, if workers continue to demand more compensation for their work, it is going to be much harder to get out of this situation without risking a recession.

For this reason, the UK CPI data will also be closely examined. It will be released on Wednesday morning at 7 a.m., and markets are expecting the monthly reading to have ticked up in September to 0.4% from the 0.3% seen in August. Again, this will put further pressure on the BOE to act forcefully to slow consumer spending, which will increase the odds of a rate hike at the bank’s next meeting on November 2nd.

According to Reuters, markets are now pricing in a 73% chance that the BOE will leave rates unchanged. A stronger-than-expected reading in either of the two data points mentioned above could shift that percentage in the coming days. If so, markets will likely move accordingly, with a higher risk premium assigned to UK assets, meaning GBP could extend the recent pullback and the FTSE 100’s outperformance in equity markets could be jeopardised.

GBP/USD put in a solid effort last week as the US dollar followed yields lower, but the stronger-than-expected US CPI data released on Thursday ended the pair’s 6-day bullish streak. The pullback seems to have lost steam in this new week, with GBP/USD up 0.3% as of Monday midday, but it’s likely that traders will proceed with caution ahead of the data, especially given how energy costs have risen recently and the effect that is expected to have on households and consumer prices.