View of the City of London’s illuminated financial district skyline at dusk. Source: getty images

The FTSE 100 enjoyed its best trading session since May 2022 on Thursday. The UK index rose 2.37%, ending the day at a 6-week high. The momentum started early in the morning, but the move gained traction in the afternoon after the European Central Bank (ECB) signalled the end of rate hikes.

The momentum so far has followed into Friday’s session pushing the FTSE 100 to break above the previous resistance and trade at a new 4-month high. But buyers are getting cautious about the magnitude of the move and are starting to pull back their positions, with new short-term resistance arising at the 7,750 mark.

The RSI is at the highest it has been since February but there still seems to be a bit of room before overbought conditions force a reversal. Given the current setup, we may see buyers testing the appetite to move higher all the way toward 7,800, at which point there is likely to be increased selling pressure. So far, the index has managed to break above two descending trend lines that could have offered some resistance within a descending triangle pattern, which suggests the path of least resistance could continue to the upside if it remains above these levels.

The FTSE 100 is heavily weighted by exporting companies so the likely end of rate hikes in the Eurozone would have boosted sentiment within the sector. ECB President Christine Lagarde said the focus of the bank had shifted from how high rates would go to how long they would be held there, a sigh of relief for investors that had started to show real concerns about the outlook of the eurozone economy, which has been showing real signs of weakness recently.

The UK index is also heavily impacted by industrial metal miners with many of these seeing hefty gains on Thursday as iron ore prices surged on the back of improving demand from China, which has seen a solid batch of economic data in recent days.

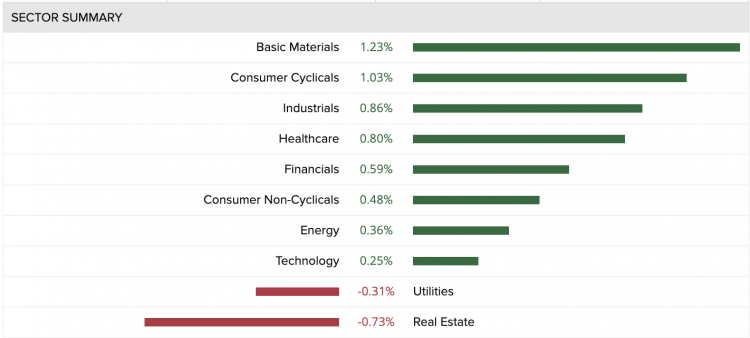

FTSE 100 sector performance summary. Source: refinitiv

Focus next week will be on the Bank of England (BoE) meeting taking place on Thursday. Market pricing is showing a 69% chance of another 25bps hike to interest rates as the latest data suggest inflation will remain a concern for the foreseeable future as wage growth continues. But there is some concern that the central bank will take a dovish stance at the meeting next week, even if rates are increased by 25bps (like what we’ve seen from the ECB). If so, the UK stock market may get a bit of a boost from this scenario – but it’s likely that the pound will see losses intensify as traders hedge their positions from the risk of persistently high inflation damaging growth in the future.