Meta (META) will deliver its Q3 earnings after the closing bell on Wednesday. We preview what the markets are expecting heading into the results.

What are analysts forecasting for Meta’s Q3 results?

| Revenue | EPS | Advertisement Revenue | 4 EPS Guidance | |

| Estimate | $33.57B | $3.63 | $32.98B | $4.84 |

Forecasts by Reuters

As per Reuters estimates, earnings per share are expected to come in at $3.63 for Q4, up from $2.98 in Q2 and $1.64 in Q32022. Net income is forecasted to be the highest since Q4 in 2021 as advertisement revenue is expected to come in at an all-time high of $32.98B.

The company’s cost-cutting measures are expected to have paid off with SG&A expenses expected to have dropped over 30% in the past year, followed by a 12% drop in selling and marketing expenses, as per forecasts from Reuters. This, coupled with growing revenue – which is expected to have grown 21% in the year – is leading to high expectations about Meta’s Q3 earnings. It’s also likely that the AI drive has helped advertising engagement and strengthened its digital ad marketing heading into the holiday season.

It’s likely that markets will pay close attention to Meta’s monthly active users across its family of products as the social media giant faces strong competition from other platforms like TikTok and BeReal.

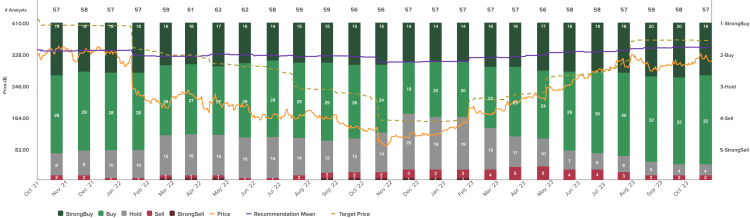

Broker recommendations and consensus price target

| Strong Buy | Buy | Hold | Sell | Strong Sell | Consensus Price Target |

| 19 | 32 | 4 | 2 | 0 | $362 |

Analysts polled by Reuters continue to be bullish on Meta’s stock, with 89% opting for a strong buy or buy recommendation. The consensus target price is currently at $362, roughly 17% higher than where it currently stands.

META share price: technical analysis

Earnings in Q2 beat expectations and boosted Meta’s stock higher back in July, reaching an 18-month high at $326. The momentum was quickly reversed leading the stock to drop 13% in the first 3 weeks of Q3. Since then, buyers have come back in as the big tech stocks continue to dominate the playing field and the stock has once again pushed above the yearly highs. The short term continues to be skewed to the upside but recent concerns about the escalation of tensions in the Middle East, coupled with a continued rise in US yields and a hawkish Fed, have weighed on sentiment and shifted the momentum lower once again. As mentioned above, based on polls carried out by Reuters, analyst consensus is for the stock to rise towards $362 over the coming months.

META daily chart

Past Performance is not a reliable indicator of future results.